Introduction

A growing body of literature in media industry studies has pointed out that the subfield has historically focused on the production and consumption of media products but has, in the process, overlooked the important “space between”1 these stages: distribution.2 If one follows this media industry as a “value chain” consisting of production → distribution → consumption, then there remains a critical omission that initiates this chain: financing. Indeed, financing is a critical stage in the life cycle of media. It is the phase in which film and television companies and their titles go from nothing to something, zero to one. It can represent a broad ecosystem of different types of financing, whether corporate financing (of a media corporation), project financing (of individual television seasons or films), or revenue models (how media firms monetize their operations). In this article, I call attention to one aspect of media finance—in this case, how corporations in the television industry raise and maintain finance capital—and consider how this type of financing can affect both television texts and target audiences.

Taking a historical approach, I detail the political economy of postwar US network television in general and the American Broadcasting Company (ABC) in particular. I ask how the financialization of television, in part, ignited ABC’s change in programming and audience targeting strategies in the 1950s. After a brief literature review, this case study is divided into two sections. First, I outline the shifting financial conditions of ABC from approximately 1953 to 1964, as it changed hands from a single-industry “pure play” firm to the subsidiary of a diversified corporation. Second, I focus on ABC’s pivot to Hollywood genres (i.e., westerns, detective series, and “children’s programs”) and theorize how the target audiences associated with such programs (i.e., children, housewives, and rural viewers) were commodified and valued by financial stakeholders. Connecting the content of television texts to industry structures, I argue that ABC’s market valuation initially remained low in the 1950s, despite its improving performance, due to Wall Street’s perception that the network’s programming was not attracting the “right” audience and that broadcasting as a whole was too volatile. In response to such concerns, networks made strides to cater their corporate strategies and texts to financial stakeholders.

I utilize a critical discourse analysis to make sense of ABC’s financial and ratings performance in the 1950s. A key primary source for this analysis is a two-part article from two 1964 editions of the trade magazine Television, both of which were written by trade journalist and editor Morris Gelman. Gelman’s articles, the “Focus on Finance” features in Television, and data in trades like Sponsor and Broadcasting offer a valuable means to ethnographically “listen in”3 on the broadcasting industry and ascertain “a sense of the dominant discourses” of the time,4 particularly how television professionals discussed finance. I also point to other primary and secondary sources, such as mainstream press coverage, annual reports, and executive autobiographies, that contextualize the relationship between television and Wall Street.

On a theoretical level, understanding ABC’s market valuation as the financialized representation of the “price” of an audience provides a framework to understand the “financial commodity audience” and how network-era television was explicitly gendered and implicitly racialized. This framework is generative not only for broadcast historians but also for contemporary media industry scholars and those who study financialization. By placing financialization literature in conversation with “commodity audience” literature, this article offers a link from early 20th-century single-industry corporations that focused on steady revenue and internal reinvestment to the types of financialized media firms today that value inflated stock prices and a portfolio of intangible assets. These findings illustrate the extent to which media firms represent some of the earliest nonfinancial corporations to become financialized, largely due to the intangibility of their assets and the discursive flexibility of their audiences. Therefore, this case study foregrounds why it is necessary to turn the structural microscope of media history to the period before neoliberalism and the deregulation of the 1980s and 1990s.

Literature Review

Financialization

This case study is distinctive because it focuses, first, on a pre-Reagan era of financialization and, second, on corporate financialization specifically. Wielding many definitions, financialization refers to the increasing power of financial institutions, actors, and ideologies in nearly all aspects of the economy.5 A romantic perspective on media financialization—whether contemporary or historical—might frame it as an outsider versus insider battle that vilifies finance capital and exalts artistic production. However, the relationship between finance and culture is more intertwined and ambivalent. Although financialization is traditionally associated with the rise of complex financial instruments and institutional investors in the 21st century, meso- and microeconomic approaches have pointed out that financialization is not merely a matter of external capital pressuring an innocent nonfinancial firm into short-term, profit-seeking behavior; financialization can also represent an internal reorientation of nonfinancial firms and practices.6 A body of critical finance and accounting scholarship has narrowed in on the contemporary process of “corporate financialization,” which can be measured using three key indicators: a rise in debt and financial assets within nonfinancial firms, an increase in intangible assets relative to tangible assets, and a rise of the shareholder value orientation.7 These forces have reorganized corporations from “a system of production to a system of investment.”8 Archival trade sources suggest that ABC and its parent company pursued some of these objectives and represented an early, perhaps primitive, form of corporate financialization. In addition, this case study is distinctive because most recent scholarship (justifiably) focuses on either the post-2008 financial crash or the liberalization of financial markets. Critically, however, there have been earlier cycles of financialization prior to the 21st century, and financialization is a fundamental consequence of capitalism, rather than an aberrant manifestation of it.9 It is valuable, therefore, to take a historical approach to media financialization by charting the continuities and changes in the film and television industries before the late 20th century.

This is not to say that media researchers have ignored the relationship between Wall Street and media industries. Andrew deWaard, for example, has detailed the infiltration of financial actors like private equity firms into Hollywood after the 2008 financial crisis.10 Colin Crawford has also studied how financial logics within the television industry have led some streaming television executives to construct “investor lores” to inflate their market value.11 With financialization at the center of contemporary media industries research, it is worth turning the field’s attention to the seeds of financialization present earlier in the 20th century. Media historians have certainly charted how media conglomerates became more adherent to the demands of Wall Street and shareholder value, in part due to the deregulation of media industries.12 Similarly, political economists have studied earlier manifestations of financialization, such as how early radio and cinema served as critical tools for financial and imperialist powers in the interwar period13 or how New York banks shaped the early Hollywood studio system.14 Considering these earlier works, this case study is not an “origin” of media financialization. Rather, it contributes to a body of scholarship that is “integral to our efforts to understand the history and present reality of the political and economic forces that structure our profoundly unequal world.”15 Still, this article’s meso-level approach is distinctive because it details how post-war media corporations were restructured from the inside out, rather than the outside in. In doing so, it suggests that studying media history in particular offers insights for financialization scholarship outside of media studies, in that early cultural industries are paradigmatic of the type of corporate financialization that has come to define nearly all industrial sectors today.

US Broadcasting History

There was nothing natural or inevitable about the structure of US network television or the primacy of its three players. A series of cross-industrial, political, financial, and cultural factors affected the structure of early television.16 Media historians, such as Michele Hilmes, Christopher Anderson, Tino Balio, Douglas Gomery, and Jennifer Porst, have detailed the complex relationship between the US film and television industries in the network era and the critical role of many interindustry stakeholders, such as advertisers, the Nielsen Corporation, and the US government, particularly the Federal Communications Commission (FCC).17 Still, the finance industry has yet to be a central focus of critical18 television scholarship, so this article adds to the important historical work on the relationship between television and film by detailing how Wall Street contributed to the entrance of Hollywood in television.

There are also plentiful industry-level studies of network television19 and firm-level case studies on CBS and NBC,20 but there remains less work on the third-place ABC. Television historians Christopher Anderson and James Baughman have offered accounts of network-era ABC, including its relationship to Wall Street, and detailed ABC’s weaker competitive position relative to CBS and NBC. Historian William Boddy suggests this disadvantage was largely due to FCC actions like the licensing freeze and ABC affiliates’ weaker frequency allocations on Ultra High Frequency (UHF) channels.21 In response to its poor position, ABC sought out finance capital in order to build new stations and improve program quality, but in the process of acquiescing to Wall Street, ABC became vulnerable to financialization. A thorough history of television’s relationship to Wall Street would help contextualize these industrial shifts, changes in corporate governance, and the complex business logics undergirding the range and nature of network-era television programming. This article offers a small contribution to this piece of media history.

The Commodity Audience

Critical political economists of communication have long debated how to conceptualize the television audience, particularly considering the medium’s unique economic features. Dallas Smythe first argued that television audiences provided the industry with “free labor” by watching advertisements. The television industry thereby exploited audiences, turning them into an “audience commodity.”22 This dynamic intensified in the 1950s when the industry transitioned from the sponsorship model, whereby companies and their advertising agencies produced and financed programs to promote their brands, to the spot advertising model, whereby networks and production companies produced programs with a variety of pre-paid advertisements during breaks; in the latter context, networks sold audiences to advertisers rather than simply time blocks on their schedules.23 Critics of Smythe’s theory, however, note that he overlooks both audience agency and the constructed nature of audience ratings.24 Eileen Meehan would also shift Smythe’s framework from one of audience exploitation to one in which the industry ignores real audiences altogether.25 Meehan argues that advertisers purchase a network’s “commodity audience”: a small but shifting group of viewers who are the most likely to buy advertised products. As a result, “real” audiences are consumers of none of these markets and are instead commodities exchanged alongside ratings and television programs.

Other political economists have since used the audience commodity formulation to address exploitation in other contexts.26 I contribute to this body of literature with a new commodity audience formulation: the financial commodity audience. Unlike Smythe, who grounds his thesis on labor exploitation, I, like Meehan, place the locus of the (financial) commodity audience firmly within industry discourse, not within the act of watching television. As this case study suggests, there has existed, for decades, a discursive exchange whereby networks pitch and negotiate the value of their audiences to financial stakeholders.

ABC-TV (1953–1964)

The Structural Financialization of ABC

ABC was formed in 1943 when the FCC forced the Radio Corporation of America (RCA) to sell its second-tier radio network “NBC Blue” to an outside buyer. RCA found a buyer in the “candy tycoon” Edward J. Noble.27 Although RCA was the product of a financialized political economy, ABC was less so because it was initially an independent firm owned by one individual: Edward Noble. Over time, however, Noble would accumulate unsustainable levels of debt: US$4 million to help purchase the network in 1943, another round of debt financing to launch a television division in 1948, and a revolving line of credit to build new radio stations between 1943 and 1950.28 By the early 1950s, commercial banks refused to loan Noble more money, and the company’s outlook was too dismal for additional stock issuances.29 Near bankruptcy in 1951, Noble had almost no option but to sell to an outside party in the hopes of recouping his investment. Luckily for Noble, ABC received an offer from United Paramount Theatres (UPT)—the theater chain formerly owned by Paramount Pictures.30 After two years of review, the FCC approved UPT’s US$25 million purchase of ABC in 1953.31 Altogether, the plight of Noble foregrounds the unsustainability of single-industry, privately owned media firms like ABC because, on the one hand, the network needed outside capital to compete against larger diversified oligopolists like RCA (NBC) and CBS, but, on the other hand, it needed to cede power to finance capitalists in order to do so.

Initially, brokerage firms and other “financial men” had strongly advised UPT’s chief executive Leonard Goldenson that he should not to acquire ABC. Wall Street was wary of the “unconventional merger” due to the general uncertainty of the broadcasting sector, the belief that there was no “room for three networks,” and the poor competitive position of ABC, which had low clearance rates, few affiliated stations, and UHF channels that many set owners could not access.32 In response, Goldenson crafted a compelling pitch to convince his investors that he would grow the newly renamed American Broadcasting-Paramount Theatres (AB-PT) and become a legitimate player. However, in the process of following through on his pitch, Goldenson and his executives would open the door for ABC’s gradual financialization. In what follows, I expand on how this process unfolded by offering six key structural changes that fundamentally reconstituted ABC during this period.

First, AB-PT was already subject to the explicit oversight of finance capital before the ABC acquisition. The company’s seven-person board of directors included two Wall Street members: one from a brokerage firm and one from a prominent bank.33 Although these board members did not necessarily oversee the firm’s day-to-day operations, they could exert power through allocative control, which includes setting long-term company policies (including financial policies) and allocating resources.34 The presence of finance board members suggests that Wall Street could have constrained ABC’s resources or encouraged a prioritization of financial objectives over employee welfare, viewers, or the public good.35 While it is tempting to look at ownership and board memberships to identify explicit evidence of financialization, this, as David Hesmondhalgh notes,

misses the point. It is not the interests of particular individuals that are at stake but the interests of the social class to which they tend to belong—wealthy and powerful owners of capital with strong ties to other powerful and influential institutions and individuals.36

Therefore, a more informal and discursive manifestation of financialization—beyond ownership or explicit directives—constituted ABC’s reorientation under finance capital.

Indeed, the second indicator of ABC’s financial reconstitution was Goldenson’s reliance on personal Wall Street connections. For example, before proposing the ABC acquisition in 1951, Goldenson urged his board to meet with his close friend on Wall Street, Harry Hagerty, the Vice Chairman of Metropolitan Life Insurance, to placate their concerns about the broadcasting sector and ABC’s lack of stars and abundance of low-rated programming.37 These types of relationships and informal meetings were not uncommon in the television industry at the time.38 During this pivotal meeting prior to the ABC acquisition, Goldenson made two concessions to Hagerty and UPT’s board that, according to Goldenson, had a significant impact on the network’s programming for years to come. Specifically, he agreed that he would, first, use his connections to foster partnerships with Hollywood studios and, second, shift the network’s prime-time schedule from live to pre-filmed programs.39

The promise to move from live to telefilm series and thereby the emphasis on intangible assets represented a substantial shift from the ABC of Noble, who spent most of his final annual report celebrating the growth of brick-and-mortar assets like stations, office facilities, and equipment.40 Critical to the corporate financialization of ABC, Wall Street’s preference for pre-recorded telefilm series reflected a growing predilection for intangible assets (i.e., intellectual property) over tangible assets (e.g., stations and equipment) in the second half of the 20th century. Such a prioritization would allow ABC to more easily inflate the value of telefilm series41 on its balance sheet by categorizing them as intangible assets or “goodwill.” Although this accounting practice would become common as industries became increasingly service-based in the late 20th century, it was less common in the postwar period.42 Put another way, cultural institutions and their products were particularly susceptible to financialization due to their intangibility and pliability. This demonstrates how studying the history of media industries in particular is valuable in trying to make sense of financialization in general.

Third, Goldenson would solidify ABC’s reliance on established financial institutions for credit. For example, to afford the expensive licenses for Hollywood telefilm series, Goldenson secured a 1956 loan from six different banks, one of which was Metropolitan Insurance, where his friend Hagerty was a vice chairman.43 Notably, this loan consisted of US$37.2 million to pay down ABC’s old debt and only US$27 million in new credit to support production costs, leaving ABC in a cycle whereby it took on new debt to pay off old debt. In the following year, AB-PT again turned to Wall Street for more debt financing (US$60 million),44 and in 1964, it would debt finance to cover the costs of converting its operations to color.45 Overall, debt financing offered Wall Street another way to influence ABC’s allocative strategies, even if these lenders did not have board seats or ownership of AB-PT.

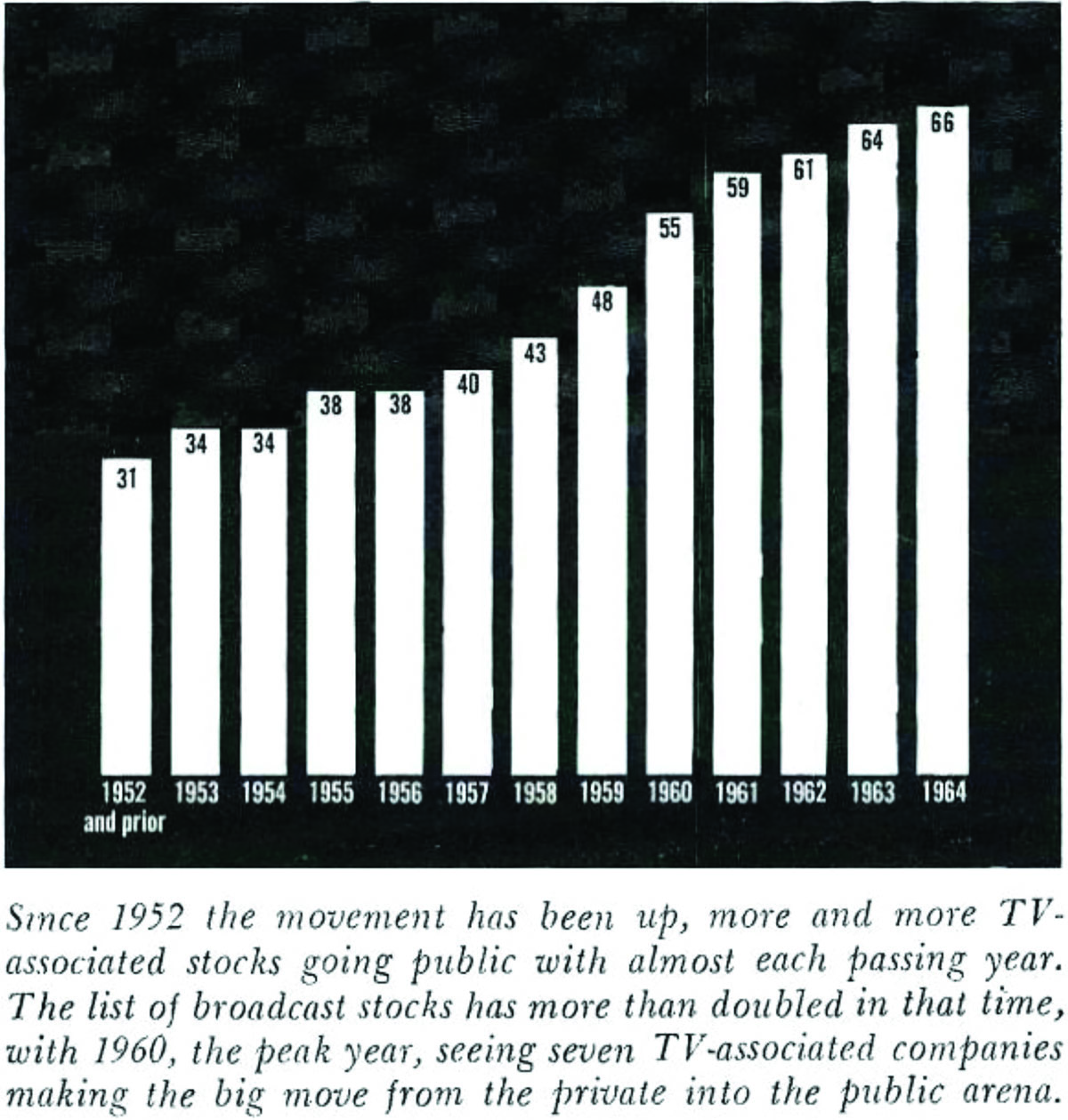

Fourth, most broadcast groups in the 1960s needed to “go public” through an initial public offering (IPO) in order to access revolving lines of credit and allow executives to compensate themselves via personal stock holdings. Before an IPO, however, a broadcaster needed to find an “underwriter” (i.e., an investment bank that could sell its stock) that recognized its “growth potential.”46 Thus, as more broadcasting groups and networks went public in the 1950s and 1960s (Figure 1), they may have catered their products to the ideologies of Wall Street or at least been cognizant of them. In the case of publicly traded media firms like AB-PT, this could have led executives to construct target audiences and programs that banks and analysts were amenable to. This often meant that public investors and their financial intermediaries pushed networks to produce high-brow programming that financial stakeholders found tasteful and to transition to telefilm series that could inflate balance sheet value.

Fifth, as more television companies went public and analysts deemed the sector “secure,” institutional investors increased their ownership stake in the industry. By the early 1960s, mutual funds and pension funds had funneled cash into station groups, telefilm companies (i.e., television production companies), advertising agencies, and the three networks.47 Some investment funds even held ownership stakes in more than seven broadcasting stations, thereby violating FCC rules. Fidelity Trend Fund, for example, held an ownership interest above 1 percent in more than 90 broadcasting stations.48 For AB-PT, mutual funds held approximately 28.1 percent of its common stock in December 1962.49

Ironically, broadcast executives in the 1950s yearned for legitimacy in the eyes of institutional investors and the access to capital that such “partnerships” could provide, but as networks became more financially “secure” in the mid-1960s, executives relinquished equity to public investors and, therefore, to the ambivalences of finance capitalism. Common institutional ownership, even if investors are “passive,” can lead to anti-competitive outcomes, increased prices, and other “hidden social costs” for consumers.50 These passive investors “need not explicitly communicate their anticompetitive incentives to management for the documented outcomes to materialize.”51 Even though institutional investors collectively maintained only a 20–30 percent ownership stake in ABC during this period, they would go on to control over 70 percent of publicly traded media firms by 2020.52 Therefore, the financialization of ABC in the postwar period represented the seeds of financialization in its contemporary form.

Sixth, institutional investors’ preference for risk mitigation incentivized broadcasters to diversify beyond a single industry, which led to the internal transformation of nonfinancial television firms into financialized entities that pursued diversified portfolios. During the postwar period, fewer and fewer firms focused on a single business or consumer base. Of the 100 largest US companies in 1939, 77 focused 70 percent or more of their business on just one industry; however, by 1979, only 23 concentrated 70 percent or more of their business on a single industry.53 This trend was no different in broadcasting. According to Television, most broadcasting companies “eyed diversification” once public because they wanted to prove to investors that they were “not happy with a lump sum of profit every quarter.”54 In addition, industry executives believed that there was a correlation between acquisitions and stock prices, so they were personally incentivized to pursue mergers and diversification.55

ABC was no exception. In the 1950s, AB-PT—which initially relied on its television division for more than half of its revenues—further diversified into related and unrelated assets. Due to FCC ownership restrictions, AB-PT looked outside television to find acquisition targets. After purchasing ABC, for example, AB-PT invested in industries as eclectic as plastics, manufacturing, and real estate.56 It would also later invest in other entertainment sub-sectors like music, publishing, and amusement and in complementary targets like Microwave Associ-ates, which presciently offered an opportunity to expand into global satellite distribution.57 In diversifying beyond broadcasting and film exhibition, Goldenson would proclaim in 1961 that AB-PT was not a media company but “an investment company.”58 This statement succinctly betrays the financialization of the nonfinancial firm, whereby corporations became containers that maintained diversified assets, rather than organizations that created economic, social, or cultural value. Political economists Stephen Maher and Scott Aquanno note how, even during the post-war period, “as top executives moved away from operational roles in specific businesses and into general entrepreneurial or investment functions, they came increasingly to resemble finance capitalists” who saw their subdivisions as “a portfolio of financial assets.”59 Although the financialization of the nonfinancial firm is traditionally associated with the period beginning with the economic downturn in the 1970s, ABC’s envelopment into a media conglomerate reflects how corporate financialization was present in media industries just two decades after World War II.

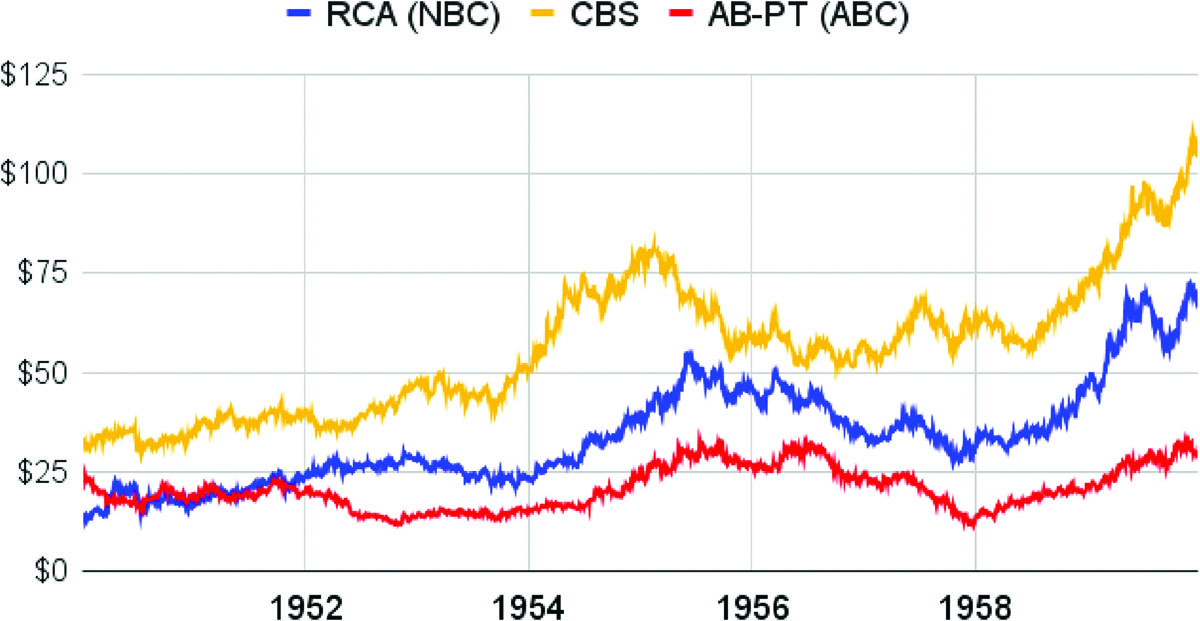

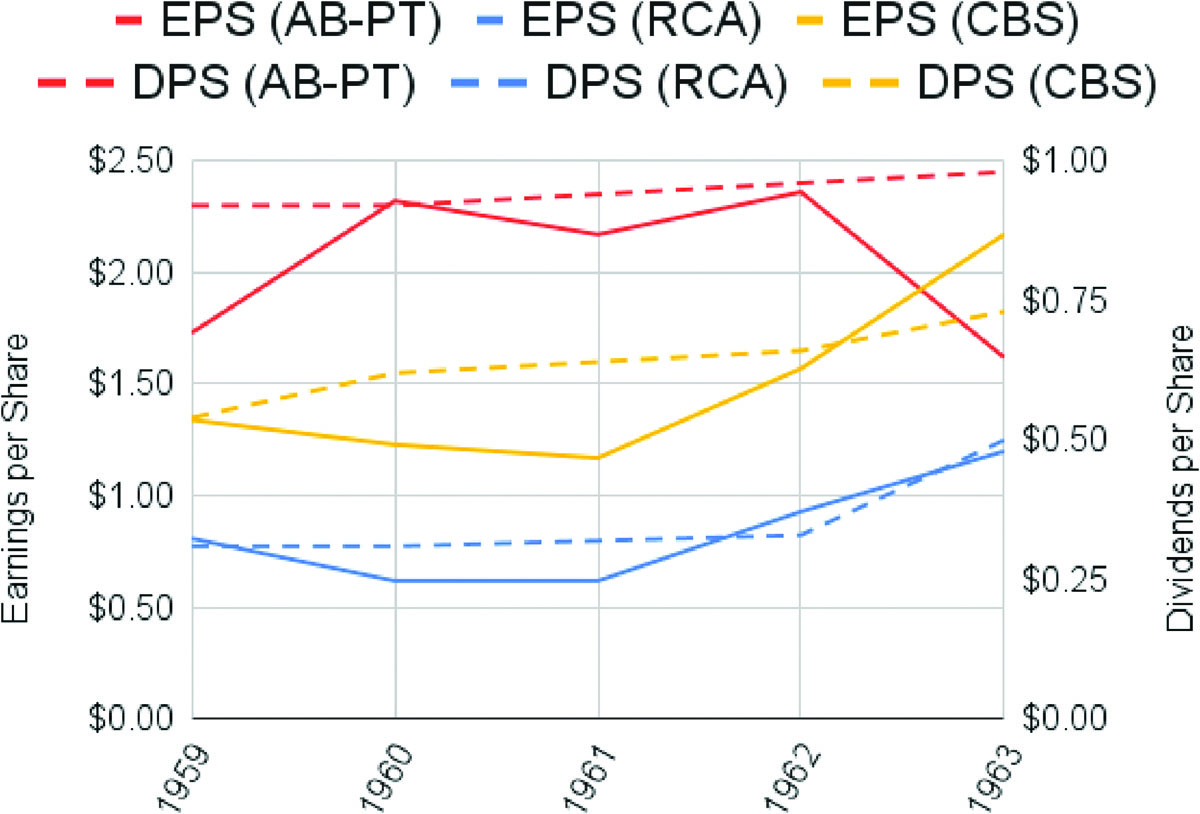

Diversification motivated by finance capital can also result in negative outcomes for media divisions relative to non-media divisions. Media economists Dan Shaver and Mary Alice Shaver find that, in comparison to non-diversified media companies, diversified conglomerates are far less likely to reinvest their profits back into their media units; they instead transfer excess capital to dividends or other divisions in the company.60 In other words, “owners of media accept that owners must make negative financial decisions for greater public obligation” (i.e., shareholder value).61 To satisfy its shareholder obligation, AB-PT’s board indeed pursued financialized objectives that were not directly beneficial to ABC. For example, AB-PT often provided outsized dividends to investors—at relative rates higher than those of CBS and RCA (NBC) (Figure 3), even though ABC’s stock was consistently cheaper (Figure 2). Goldenson and his board likely decided to keep dividends high, even when earnings dipped in 1963, because they wanted to change ABC’s reputation on Wall Street and “warm bankers up” to the network. Through this process, however, AB-PT transferred the wealth created by ABC and its employees to the financial elite in order to satiate the doctrine of shareholder value.

ABC’s pursuit of diversification was also an attempt to insulate itself from the unpredictability of television and Nielsen ratings. For example, when ABC attempted to merge with the telecom giant International Telephone and Telegraph Company (ITT) in 1967, executive testimony revealed the power of financialized logics in ABC’s corporate governance. In its hearings with the FCC and Department of Justice, ABC’s legal team tried to justify the ITT deal by arguing that ABC needed to diversify “so that every adverse rating doesn’t produce a disastrous drop in the price of the stock.”62 Clearly, a more diversified scope of operation would have also insulated AB-PT executives (and their paychecks) from the vicissitudes of cultural production. Further, investors were attuned to network ratings and factored the commodity audience into market pricing. However, it was more than just audience size that determined the value of ABC’s financial commodity audience.

Financialization and Early ABC Programming

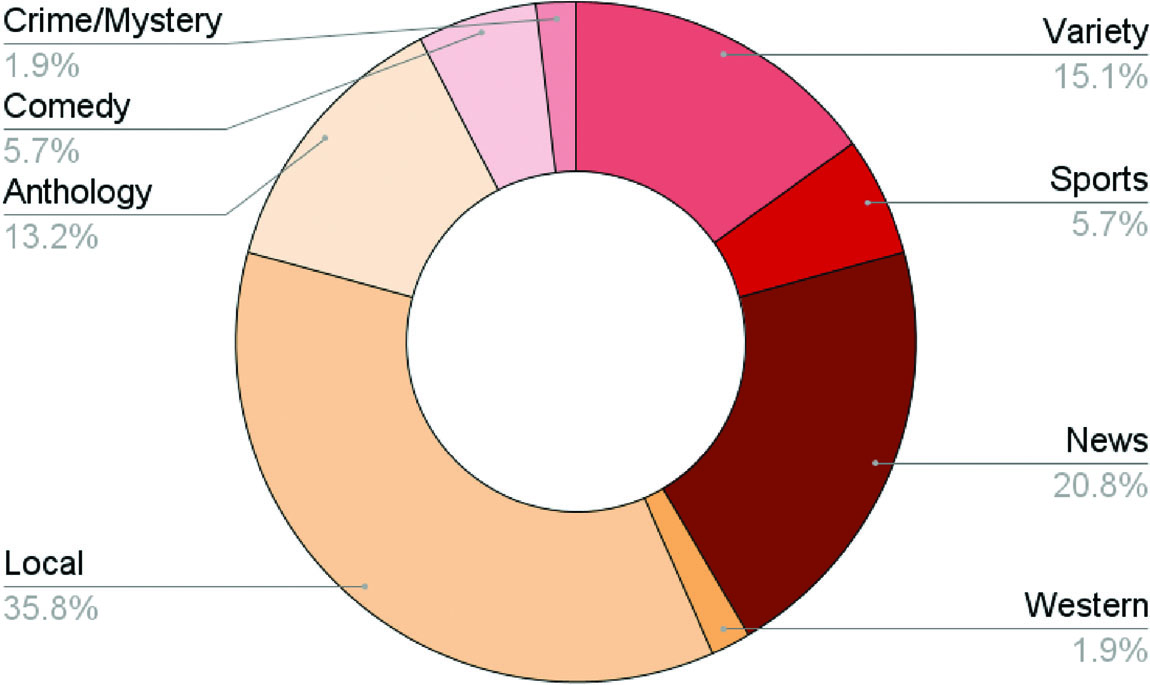

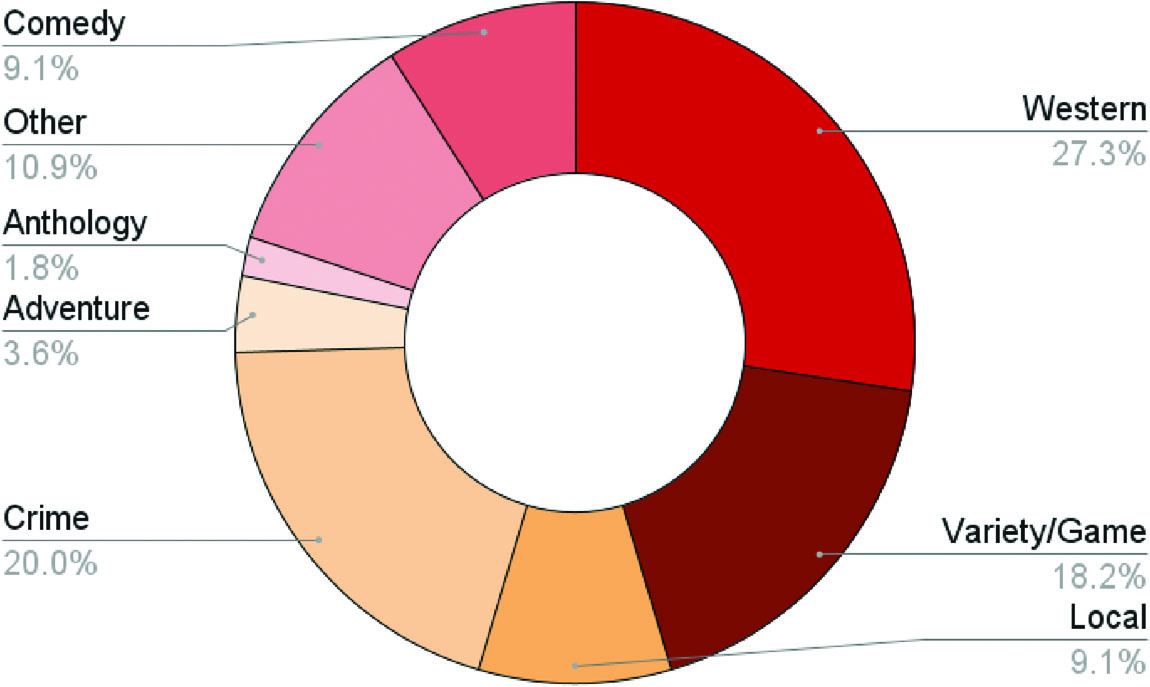

Between 1952 and 1959, there was a notable shift in ABC’s prime-time schedule and target audience. Initially, ABC under Noble had copied the other networks’ content strategies by relying on popular radio genres like variety shows and anthologies (Figure 4; see also Appendix, Table 1). Believing that the only way to compete against NBC and CBS was to “counterprogram” against their schedules,63 Goldenson would later transition ABC from news and live anthology series to pre-filmed Hollywood genres (Figure 5; see also Appendix, Table 2).64 According to Goldenson, “Hollywood production values” would differentiate the third-place network and break away from the perceived low quality of live content. By improving the quality of its programs, ABC aimed to attract more affiliates and improve its “clearance rates” (i.e., the percentage of ABC programs that affiliate stations “accepted” to air).65 In addition to improving quality, pre-filmed content was, according to ABC’s bankers, cheaper than live content and provided producers with long-term assets that could provide recurring cash flows.66 By 1959, 62 percent of ABC’s schedule was non-live programming, which far outpaced CBS and NBC.67 The move to telefilm transformed the ephemerality of live television into a tangible asset portfolio of pre-recorded content that could be mined for profits in the future. Thus, ABC’s telefilm assets finally provided investors with more than just a “lump sum” of capital every quarter.68

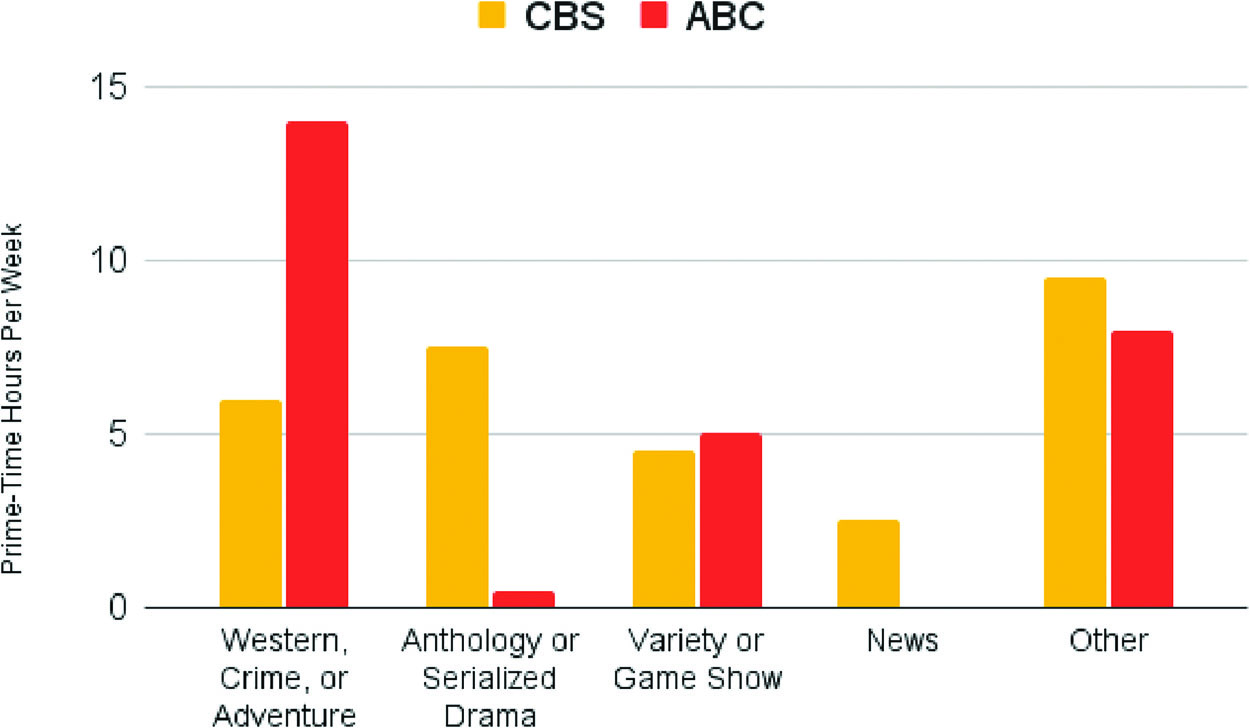

To fill out its prime-time schedule, ABC started to form partnerships with Hollywood studios and experiment with different programs and genres in the mid-1950s. Initially, in 1954, it licensed “serious” programs from studios, such as high-brow adaptations of classic feature films like Casablanca (Michael Curtiz, 1942) and Kings Row (Sam Wood, 1942). However, when these adaptations proved to be critical and commercial failures,69 ABC pursued a previously overlooked demographic: children and housewives who were “dissatisfied with radio-style fare.”70 For example, ABC counterprogrammed against the popular (and older-skewing) variety show Arthur Godfrey and His Friends (CBS, 1949–1959) with the children-oriented Disneyland (1954–present), which quickly became a top ten-rated program.71 The network subsequently added two additional Disney programs: the three-part Davy Crockett (1954–1955) in December 1954 and The Mickey Mouse Club (1955–1959) in October 1955.72 In addition to Disney, Warner Bros. would go on to provide ABC with some of its most popular youth-oriented series, such as the western Cheyenne (1955–1962) and the detective series 77 Sunset Strip (1958–1964). According to Baughman, these series targeted not only children but also young women because the leads were “young and handsome” heroes.73 Moreover, westerns, country music programs like Ozark Jubilee (1954–1961), and rural sitcoms like The Real McCoys (ABC, 1957–1962; CBS, 1962–1963) appealed to audiences in the South and Midwest, where more stations were launching after the licensing freeze ended in 1952.74 In sum, between 1952 (Figure 4) and 1959 (Figure 5), ABC shifted its prime-time schedule from primarily news, anthologies, and variety programs to nearly 50 percent westerns and detective/crime series, which were in sharp contrast to the “adult” genres like anthologies and news programs still on NBC and CBS (Figure 6).

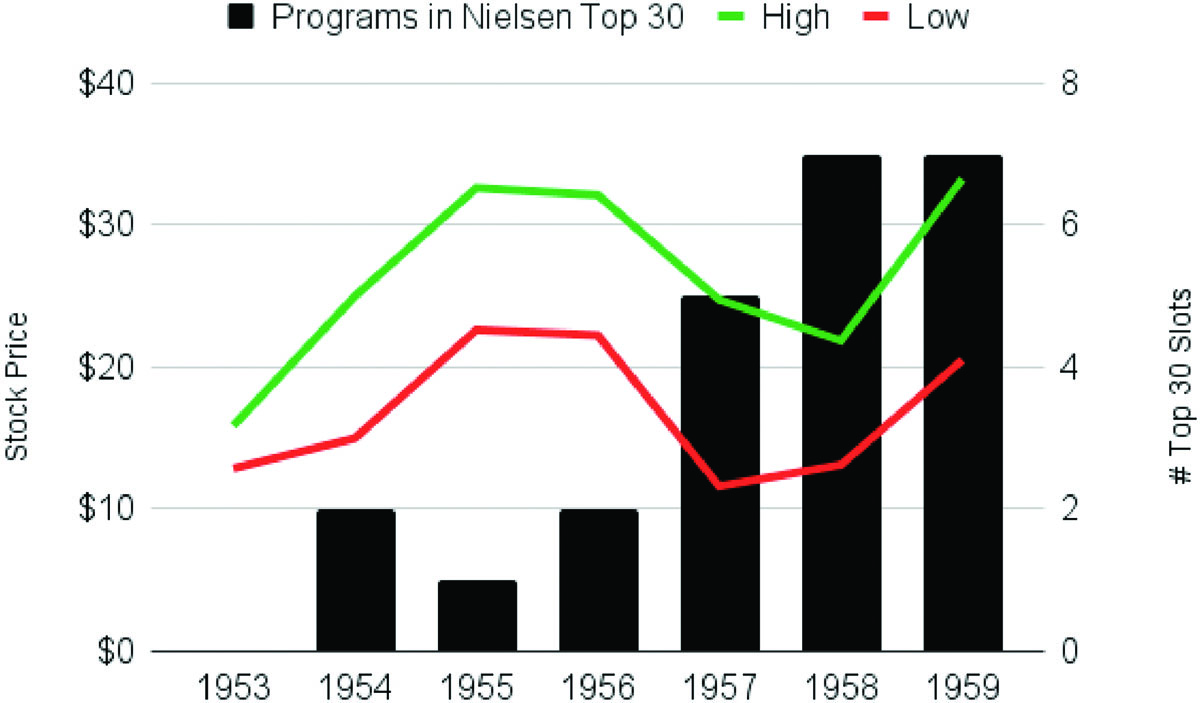

Thanks to these programming strategies, ABC-TV (the broadcast division of AB-PT) became more financially and commercially successful by the late 1950s. In AB-PT’s first full year of ownership of ABC (1954), for example, ABC-TV increased its revenue by 67 percent and sold its entire inventory of prime-time advertising spots.75 By the end of the decade, ABC would also have seven shows in the Nielsen top 30 (Figure 7), advertising revenue for the entire industry would eclipse US$1.35 billion, and television’s home saturation would reach nearly 90 percent.76 Even though ABC remained the third-place network, the outlook for the entire industry was overwhelmingly positive for investors, and each network was growing considerably. However, AB-PT still struggled to “legitimize itself” to Wall Street. Seemingly nothing, not even the legitimacy of ABC’s Hollywood deals, would “warm bankers to the third network.”77 Relative to RCA (NBC) and CBS, ABC’s stock price remained low throughout the 1950s (Figure 2), even though the three networks had similar stock prices at the start of the decade, and ABC consistently returned relatively higher dividends and earnings per share than its competitors (Figure 3). Even as late as 1963, when ABC-TV was profitable, brokerages still advised against purchasing AB-PT (see stock prices in Figure 8).78

Why did ABC’s market valuation remain flat between 1954 and 1960, despite its improved ratings and financial performance (Figure 7)? Why would investors seemingly “leave money on the table” and ignore ubiquitous financial metrics? In part, this aversion to ABC can be traced to class-based taste cultures and the centrality of hegemonic ideologies in industry discourse. First, regarding taste cultures, ABC’s turn from “prestige” programs (i.e., musical specials, variety shows, and anthology dramas) to “genre” programs (i.e., westerns, detective serials, rural sitcoms) was received poorly on Wall Street, according to Television magazine. For example, when ABC dropped Voice of Firestone (NBC, 1949–1954; ABC, 1954–1959), a long-running variety series featuring opera and classical music, investors were “indignant” because this may as well have signaled “the end of culture in America.”79 In other words, Voice of Firestone connoted a particular upper-class taste culture for investors. Second, Wall Street’s negative view of ABC also derived from the social status of ABC’s imagined viewers: children and their mothers and, to a lesser extent, rural and suburban audiences. Foundational scholarship in television studies has noted the distinction between “Quality TV” genres like anthologies and certain dramas, which are masculinized and associated with other already “legitimated” urban art forms like theater and art cinema, and culturally denigrated genres, which are often feminized and associated with commercialism.80 Altogether, the simultaneous stagnation of ABC’s stock value and improvement of ABC’s corporate finances and programming suggests that there was a perceived value, however imprecise, that white male Wall Street stakeholders placed on audiences.

AB-PT did its best to try to promote the value of its viewers to Wall Street. In its 1955 annual report, the firm touted that The Mickey Mouse Club was not only the highest-rated show for children but also attracted women in the daytime slot.81 Similarly, in response to complaints about Voice of Firestone in 1959, Goldenson urged investors that those viewers were not “the audience we want anyway”; instead, they wanted “bigger younger audiences.”82 Goldenson even claimed that ABC wanted to lure “the young housewife—one cut above the teenager—with two to four kids, who has to buy the clothing, the food, the soaps, the home remedies.”83 Nonetheless, financial stakeholders were resistant to this “investor lore” because Wall Street deemed these audiences “niche” and preferred elite urban viewers who watched, for example, anthology dramas. Altogether, Wall Street’s preference for particular programs and audiences exposes “the difference between the commodity audience and the people who actually watch television.”84

Indeed, the broadcasting industry has (almost always) valued a specific segment of prime-time audiences: white working adults, primarily men. As Meehan suggests, even profit maximization reaches its limits in the face of other social and identity-based power dynamics.85 In this case, Wall Street overvalued urban white male audiences in primetime, viewing them as the audience, even though housewives were (according to another patriarchal ideology) the primary buyers of advertised household items.86 In addition to sexism and class elitism, racism was also “priced into” financial markets because the ideal commodity audience remained white; however, race was exnominated altogether and not observably addressed in this discourse. Although contemporary economists might deem this lack of objectivity from Wall Street an aberration or a “market error,” ambivalence and contradiction such as this are fundamental to the operation of a hegemonic capitalist system.

Conclusion

In summary, the structures and discourses of network-era television offer an early case study on the financialized state of US television firms, programs, and audiences—far before the neoliberal policies of the 1980s. In just one decade between 1953 and 1964, ABC reoriented itself toward financialized objectives, such as increasing dividends and diversifying into unrelated industries, without explicitly being told to do so. Further, ABC went to great lengths to appease the finance industry and pitch its programs and audiences in a way that Wall Street was amenable to. When financial stakeholders decided that ABC was not attracting the “right” audience, its market valuation suffered. Adding finance capitalists as the fourth key stakeholder to the political economy of network television (in addition to networks, advertisers, and Nielsen), I argue that the “financial commodity audience” has represented an ongoing exchange of a commodity (i.e., an imagined audience) for a price (i.e., a stock price, access to capital). Critically, this remains a transaction that both reflects and reifies broader social power structures.

As this article focuses on a narrow phenomenon and period in the television industry, future research can build upon this framework. This research was limited to digitally available sources, particularly trade magazines, due to the context in which it was conducted during the Covid-19 pandemic, so future research can turn to other corporate archival material to chart the financialization of ABC and other television firms. Beyond my organizational-level analysis, future scholars can consider the many other changes to the form of the financial commodity audience since the mid-20th century. For example, in the period immediately following this case study, the conglomerates that owned television networks continued to diversify into different sectors, effectively decoupling adverse ratings from stock dips, just as Goldenson had desired. Additionally, the Nielsen audience would skew younger and more urban in the late 1960s, perhaps shifting the discursive constitution of the financial commodity audience. Today, subscription video-on-demand platforms have started to replace, or at least augment, linear viewing. Concurrently, traditional rating systems have become more complicated, as streamers shield and manipulate their data. As a result, there is less of a clear correlation between stock prices and viewership. Research could consider, for example, how streaming television executives now pitch subscriber affect (or, in their terms, “passion”) as more important than standardized viewership numbers. Investigating how executives position this passion on Wall Street could be another avenue to address how industry structures intersect with, but by no means outright determine, texts and audiences.

Notes

- Alisa Perren, “Rethinking Distribution for the Future of Media Industry Studies,” Cinema Journal 52, no. 3 (2013): 165, https://doi.org/10.1353/cj.2013.0017. ⮭

- For a recent contribution, see Paul McDonald, Courtney Brannon Donoghue, and Timothy Havens, eds., Digital Media Distribution: Portals, Platforms, Pipelines (New York: New York University Press, 2021). ⮭

- Thomas F. Corrigan, “Making Implicit Methods Explicit: Trade Press Analysis in the Political Economy of Communication,” International Journal of Communication 12 (2018): 2751, https://ijoc.org/index.php/ijoc/article/view/6496/2395. ⮭

- Alisa Perren, “The Trick of the Trades: Media Industry Studies and the American Comic Book Industry,” in Production Studies, The Sequel!, ed. Miranda Banks, Bridget Conor, and Vicki Mayer (New York: Routledge, 2015), 228. ⮭

- Gerald A. Epstein, “Introduction: Financialization and the World Economy,” in Financialization and the World Economy, ed. Gerald A. Epstein (Northampton, MA: Edward Elgar Publishing, 2005), 3. ⮭

- Stephen Maher and Scott M. Aquanno, “The New Finance Capital: Corporate Governance, Financial Power, and the State,” Critical Sociology 48, no. 1 (2021): 62, https://doi.org/10.1177/0896920521994170. ⮭

- Tobias J. Klinge et al., “Augmenting Digital Monopolies: A Corporate Financialization Perspective on the Rise of Big Tech,” Competition & Change (June 2022): 5–6, https://doi.org/10.1177/10245294221105573. ⮭

- Maher and Aquanno, “The New Finance Capital,” 62. ⮭

- Fernand Braudel, Civilization and Capitalism, 15th–18th Century (New York: Harper and Row, 1984); Giovanni Arrighi, The Long Twentieth Century: Money, Power and the Origins of Our Times (London: Verso, 2010). ⮭

- Andrew deWaard, “Financialized Hollywood: Institutional Investment, Venture Capital, and Private Equity in the Film and Television Industry,” Journal of Cinema and Media Studies 59, no. 4 (2020): 54, https://doi.org/10.1353/cj.2020.0041. ⮭

- Colin Jon Mark Crawford, Netflix’s Speculative Fictions: Financializing Platform Television (Landham, MD: Lexington Books, 2020), 5. ⮭

- Jennifer Holt, Empires of Entertainment: Media Industries and the Politics of Deregulation, 1980–1996 (New Brunswick, NJ: Rutgers University Press, 2011); Thomas Schatz, “The Studio System and Conglomerate Hollywood,” in The Contemporary Hollywood Film Industry, ed. Paul McDonald and Janet Wasko (Malden, MA: Blackwell Publishing, 2008). ⮭

- Lee Grieveson, Cinema and the Wealth of Nations: Media, Capital, and the Liberal World System (Oakland, CA: University of California Press, 2018). ⮭

- Janet Wasko, Movies and Money: Financing the American Film Industry (Norwood, NJ: Ablex, 1982). ⮭

- Grieveson, Cinema and the Wealth, 20. ⮭

- Michael Kackman, “Television before the Classic Network Era: 1930s–1950s,” in Companion to the History of American Broadcasting, ed. Aniko Bodroghkozy (Hoboken, NJ: John Wiley & Sons, 2018), 71–91. ⮭

- See Michelle Hilmes, Broadcasting and Hollywood (Champaign, IL: University of Illinois Press, 1990); Christopher Anderson, Hollywood TV: The Studio System in the Fifties (Austin: University of Texas Press, 1994); Jennifer Porst, Broadcasting Hollywood: The Struggle over Feature Films on Early TV (New Brunswick, NJ: Rutgers University Press, 2021). ⮭

- Although media economics and management have addressed media finance, such approaches are distinctive from the critical political economic and cultural studies traditions that undergird critical media studies. ⮭

- See William Boddy, Fifties Television: The Industry and Its Critics (Chicago: University of Illinois Press, 1993); Erik Barnouw, The Image Empire: A History of Broadcasting in the United States, vol. 3 (New York: Oxford University Press, 1970). ⮭

- See Michelle Hilmes, ed., NBC: America’s Network (Berkeley: University of California Press, 2007). ⮭

- Boddy, Fifties Television, 51–53. ⮭

- Dallas Smythe, “Communications: Blindspot of Western Marxism,” Canadian Journal of Political and Social Theory 1, no. 3 (1977): 1. ⮭

- Cynthia Meyers, “From Sponsorship to Spots: Advertising and the Development of Electronic Media,” in Media Industries: History, Theory, and Method, ed. Jennifer Holt and Alisa Perren (West Sussex, UK: Blackwell Publishing, 2009), 69–80. ⮭

- See Graham Murdock, “Blindspots about Western Marxism: A Reply to Dallas Smythe,” Canadian Journal of Political and Social Theory 2, no. 2 (1978): 109. ⮭

- Eileen Meehan, “Why We Don’t Count: The Commodity Audience,” in Logics of Television, ed. Patricia Mellencamp (Bloomington: Indiana University Press, 1990). ⮭

- See Christian Fuchs, “Dallas Smythe Today: The Audience Commodity, the Digital Labour Debate, Marxist Political Economy and Critical Theory,” tripleC 10, no. 2 (2012): 706, https://doi.org/10.31269/triplec.v10i2.443. ⮭

- “Asks FCC Approval to Buy Radio Chain,” New York Times, August 13, 1943, 26, ProQuest Historical Newspapers: The New York Times. ⮭

- Ibid; Douglas Gomery and Chuck Howell, “American Broadcasting Company,” in The Museum of Broadcast Communications Encyclopedia of Radio, A-E, ed. Christopher H. Sterling (New York: Fitzroy Dearborn, 2004), 57. ⮭

- Ibid. ⮭

- Leonard Goldenson and Marvin J. Wolf, Beating the Odds (New York: Macmillan Publishing, 1991), 72. The Supreme Court’s 1948 Paramount Decrees led the major Hollywood studios to sell off their theater holdings. ⮭

- Gomery and Howell, “American Broadcasting Company,” 57. ⮭

- Albert R. Kroeger, “Miracle Worker of West 66th Street,” Television, February 1961, 60–70, World Radio History; Morris J. Gelman, “Part I: The Promise and Perils of Going Public,” Television, October 1964, 3, World Radio History. ⮭

- Goldenson and Wolf, Beating the Odds, 103–4. ⮭

- Graham Murdock, “Large Corporations and the Control of the Communications Industries,” in Culture, Society and the Media, ed. Tony Bennett et al. (New York: Methuen, 1983), 122. ⮭

- “American Broadcasting Co.,” Broadcasting Yearbook, 1960, B-12. By 1960, however, ABC would remove these two Wall Street stakeholders from its board. ⮭

- David Hesmondhalgh, The Cultural Industries, 3rd ed. (London: Sage Publications, 2013), 75. ⮭

- Goldenson and Wolf, Beating the Odds, 104–6. ⮭

- Gelman, “Part I,” 40. For example, CBS and the station group Metromedia launched a series of “educational campaigns” for traders and bankers in 1961 to inform them about the idiosyncrasies of broadcasting; analysts started producing formal “industry reports” in the following year. ⮭

- Goldenson and Wolf, Beating the Odds, 104. ⮭

- American Broadcasting Company, Annual Report (New York: ABC, 1953), Internet Archive. ⮭

- Meyers, “From Sponsorship to Spots,” 69–80. As the networks took control of their schedules in the transition to spot advertising, networks increasingly produced and (at least partially) owned the shows on their schedules, creating the opportunity to profit from such programs through syndication. ⮭

- Klinge et al., “Augmenting Digital Monopolies,” 1. ⮭

- James L. Baughman, “The Weakest Chain and the Strongest Link: The American Broadcasting Company and the Motion Picture Industry, 1952–1960,” in Hollywood in the Age of Television, ed. Tino Balio (New York: Routledge, 1990), 106–7. ⮭

- Herman Land, “ABC: An Evaluation,” Television, December 1957, 89, World Radio History. ⮭

- Goldenson and Wolf, Beating the Odds, 252. ⮭

- Gelman, “Part I,” 36–38. ⮭

- “Broadcast Stocks Win Respect,” Broadcasting, January 8, 1964, 44, World Radio History. In the 1950s, networks were not as profitable as station groups, so investors were more likely to invest in the latter. ⮭

- Morris J. Gelman, “Part II: The Promise and Perils of Going Public,” Television, November 1964, 58, World Radio History. ⮭

- “Broadcast Stocks Win,” 44. ⮭

- Jose Azar, Martin C. Schmalz, and Isabel Tecu, “Anticompetitive Effects of Common Ownership,” Journal of Finance 73, no. 4 (2018), https://dx.doi.org/10.2139/ssrn.2427345. See also Eric A. Posner, Fiona S. Morton, and E. Glen Weyl, “A Proposal to Limit the Anti-Competitive Power of Institutional Investors,” Antitrust Law Journal 81 (2017): 669, https://dx.doi.org/10.2139/ssrn.2872754. ⮭

- Azar, Schmalz, and Tecu, “Anticompetitive,” 6–7. ⮭

- deWaard, “Financialized Hollywood,” 58. ⮭

- Hesmondhalgh, Cultural, 72. ⮭

- Gelman, “Part II,” 53. ⮭

- “Focus on Finance,” Television, January 1965, 12, World Radio History. ⮭

- “ABC-Paramount, Western Union Buy into Instrument Concern,” New York Times, August 31, 1956, 21, ProQuest Historical Newspapers: The New York Times; Kroeger, “Miracle.” ⮭

- “ABC-Paramount,” 21. ⮭

- Kroeger, “Miracle,” 62. ⮭

- Maher and Aquanno, “The New Finance,” 62. ⮭

- Dan Shaver and Mary Alice Shaver, “The Effects of Governance Structure on Reinvestment Strategies of Media Conglomerate,” in Corporate Governance of Media Companies, ed. Robert G. Picard (Jonkoping, Sweden: Jonkoping International Business School, 2005), 55–57. ⮭

- Ibid., 47. ⮭

- “I.T.T. Merger Hit by F.C.C. Expert,” New York Times, June 2, 1967, 83, ProQuest Historical Newspapers: The New York Times. Despite initial signs of success, the merger never came to fruition. ⮭

- Kroeger, “Miracle,” 60. ⮭

- Anderson, Hollywood TV, 138. ⮭

- Ibid., 138–41. In 1953, ABC’s clearance rate was only 34 percent. Also, while NBC and CBS maintained 64 and 30 primary affiliates, respectively, ABC only maintained fourteen affiliates. ⮭

- Baughman, “The Weakest Chain and the Strongest Link,” 110. ⮭

- James Baughman, “ABC and the Destruction of American Television, 1953–1961,” Business and Economic History 12 (1983): 64. ⮭

- Although live programs could have been recorded via the kinescope earlier, it was not until the success of I Love Lucy (CBS, 1951–1957) that producers started to recognize the long-term cash flow value of television (i.e., syndication). ⮭

- Baughman, “The Weakest Chain and the Strongest Link,” 101–2. ⮭

- Anderson, Hollywood TV, 141. ⮭

- Ibid. ⮭

- Baughman, “The Weakest Chain and the Strongest Link,” 98–99. ⮭

- Ibid., 103. ⮭

- Baughman, “ABC and the Destruction,” 65–66. Although ABC found some success with rural programming, CBS would lean more fully into this as a brand identity in the 1960s. ⮭

- Boddy, Fifties Television, 160. ⮭

- “1958 in Review,” Sponsor, December 27, 1958, 23–24, World Radio History. ⮭

- Baughman, “The Weakest Chain and the Strongest Link,” 107. ⮭

- Ibid. ⮭

- Kroeger, “Miracle,” 62. ⮭

- See Jane Feuer, “The MTM Style,” in MTM Quality Television, ed. Jane Feuer, Paul Kerr, and Tise Vhimagi (London: BFI Publishing, 1984); Michael Newman and Elana Levine, Legitimating Television: Media Convergence and Cultural Status (New York: Routledge, 2012). ⮭

- American Broadcasting-Paramount Theatres, Annual Report 1955 (New York: AB-PT, 1956), 18, ProQuest. ⮭

- Kroeger, “Miracle,” 62. ⮭

- Anderson, Hollywood TV, 140. ⮭

- Eileen Meehan, “Gendering the Commodity Audience: Critical Media Research, Feminism, and Political Economy,” in Sex & Money: Feminism and Political Economy in the Media, ed. Eileen R. Meehan and Ellen Riordan (Minneapolis, MN: University of Minnesota Press, 2002), 217. ⮭

- Meehan, “Gendering the Commodity Audience,” 209. ⮭

- Ibid., 218. ⮭

The author wishes to thank Alfred Martin, Justin Wyatt, Shawna Kidman, Alisa Perren, Charlotte Howell, and Deborah Jaramillo for their comments and feedback on this project. As an earlier draft of this article was presented at the AEJMC 2021 Conference, the author acknowledges the valuable feedback provided by the anonymous reviewers of the Media Management, Economics, and Entrepreneurship division. The author also thanks the SCMS Media Industries scholarly interest group, particularly Jennifer Porst and Kate Fortmueller. Finally, the author thanks the anonymous reviewers of Media Industries for their insightful feedback and the editorial team, particularly Kevin Sanson, for their guidance.

This article was the winner of the 2022 Society for Cinema and Media Studies/Media Industries Scholarly Interest Group Graduate Student Writing Award. The graduate paper was anonymously refereed by members of the Media Industries Scholarly Interest Group and a member of the Media Industries editorial board. Once selected for the award, the paper proceeded through the journal’s double-blind peer review process and was revised before publication.

Bibliography

Anderson, Christopher. Hollywood TV: The Studio System in the Fifties. Austin: University of Texas Press, 1994.

Arrighi, Giovanni. The Long Twentieth Century: Money, Power and the Origins of Our Times. London: Verso, 2010.

Azar, Jose, Martin C. Schmalz, and Isabel Tecu. “Anticompetitive Effects of Common Ownership.” Journal of Finance 73, no. 4 (2018): 1–79. https://dx.doi.org/10.2139/ssrn.2427345.https://dx.doi.org/10.2139/ssrn.2427345

Barnouw, Erik. The Image Empire: A History of Broadcasting in the United States. Vol. 3. New York: Oxford University Press, 1970.

Baughman, James L. “ABC and the Destruction of American Television, 1953–1961.” Business and Economic History 12 (1983): 56–73. http://www.jstor.org/stable/23702739.http://www.jstor.org/stable/23702739

Baughman, James L.. “The Weakest Chain and the Strongest Link: The American Broadcasting Company and the Motion Picture Industry, 1952–1960.” In Hollywood in the Age of Television, edited by Tino Balio, 91–114. New York: Routledge, 1990.

Boddy, William. Fifties Television: The Industry and Its Critics. Chicago: University of Illinois Press, 1993.

Braudel, Fernand. Civilization and Capitalism, 15th–18th Century. New York: Harper and Row, 1984.

Brooks, Tim, and Earle Marsh. The Complete Directory to Prime Time Network and Cable TV Shows, 1946-Present. 8th ed. New York: Ballantine Books, 2003. Apple eBook.

Corrigan, Thomas F. “Making Implicit Methods Explicit: Trade Press Analysis in the Political Economy of Communication.” International Journal of Communication 12 (2018): 2751–72. https://ijoc.org/index.php/ijoc/article/view/6496/2395.https://ijoc.org/index.php/ijoc/article/view/6496/2395

Crawford, Colin Jon Mark. Netflix’s Speculative Fictions: Financializing Platform Television. Landham, MD: Lexington Books, 2020.

deWaard, Andrew. “Financialized Hollywood: Institutional Investment, Venture Capital, and Private Equity in the Film and Television Industry.” Journal of Cinema and Media Studies 59, no. 4 (Summer 2020): 54–84. https://doi.org/10.1353/cj.2020.0041.https://doi.org/10.1353/cj.2020.0041

Epstein, Gerald A. “Introduction: Financialization and the World Economy.” In Financialization and the World Economy, edited by Gerald A. Epstein, 3–16. Northampton, MA: Edward Elgar Publishing, 2005.

Feuer, Jane. “The MTM Style.” In MTM Quality Television, edited by Jane Feuer, Paul Kerr, and Tise Vhimagi, 32–60. London: BFI Publishing, 1984.

Fuchs, Christian. “Dallas Smythe Today: The Audience Commodity, the Digital Labour Debate, Marxist Political Economy and Critical Theory.” tripleC 10, no. 2 (2012): 692–740. https://doi.org/10.31269/triplec.v10i2.443.https://doi.org/10.31269/triplec.v10i2.443

Goldenson, Leonard, and Marvin J. Wolf. Beating the Odds: The Untold Story Behind the Rise of ABC. New York: Macmillan Publishing, 1991.

Gomery, Douglas, and Chuck Howell. “American Broadcasting Company.” In The Museum of Broadcast Communications Encyclopedia of Radio, A-E, edited by Christopher H. Sterling, 56–60. New York: Fitzroy Dearborn, 2004.

Grieveson, Lee. Cinema and the Wealth of Nations: Media, Capital, and the Liberal World System. Oakland, CA: University of California Press, 2018.

Hesmondhalgh, David. The Cultural Industries. 3rd ed. London: Sage Publications, 2013.

Hilmes, Michelle. Broadcasting and Hollywood. Champaign, IL: University of Illinois Press, 1990.

Hilmes, Michelle, ed. NBC: America’s Network. Berkeley: University of California Press, 2007.

Holt, Jennifer. Empires of Entertainment: Media Industries and the Politics of Deregulation, 1980–1996. New Brunswick, NJ: Rutgers University Press, 2011.

Kackman, Michael. “Television Before the Classic Network Era: 1930s– 1950s.” In Companion to the History of American Broadcasting, edited by Aniko Bodroghkozy, 71–91. Hoboken, NJ: John Wiley & Sons, 2018.

Klinge, Tobias J., Reijer Hendrikse, Rodrigo Fernandez, and Ilke Adriaans. “Augmenting Digital Monopolies: A Corporate Financialization Perspective on the Rise of Big Tech.” Competition & Change (June 2022): 1–22. https://doi.org/10.1177/10245294221105573.https://doi.org/10.1177/10245294221105573

Maher, Stephen, and Scott M. Aquanno. “The New Finance Capital: Corporate Governance, Financial Power, and the State.” Critical Sociology 48, no. 1 (2021): 55–73. https://doi.org/10.1177/0896920521994170.https://doi.org/10.1177/0896920521994170

McDonald, Paul, Courtney Brannon Donoghue, and Timothy Havens. “Introduction: Media Distribution Today.” In Digital Media Distribution: Portals, Platforms, Pipelines, edited by Paul McDonald, Courtney Brannon Donoghue, and Timothy Havens, 1–24. New York: New York University Press, 2021.

Meehan, Eileen. “Why We Don’t Count: The Commodity Audience.” In Logics of Television, edited by Patricia Mellencamp, 117–37. Bloomington: Indiana University Press, 1990.

Meehan, Eileen. “Gendering the Commodity Audience: Critical Media Research, Feminism, and Political Economy.” In Sex & Money: Feminism and Political Economy in the Media, edited by Eileen R. Meehan and Ellen Riordan, 209–22. Minneapolis, MN: University of Minnesota Press, 2002.

Meyers, Cynthia B. “From Sponsorship to Spots: Advertising and the Development of Electronic Media.” In Media Industries: History, Theory, and Method, edited by Jennifer Holt and Alisa Perren, 69–80. West Sussex, UK: Blackwell Publishing, 2009.

Murdock, Graham. “Blindspots About Western Marxism: A Reply to Dallas Smythe.” Canadian Journal of Political and Social Theory 2, no. 2 (Spring–Summer 1978): 109–19.

Murdock, Graham. “Large Corporations and the Control of the Communications Industries.” In Culture, Society and the Media, edited by Tony Bennett, James Curran, Michael Gurevitch, and James Wollacott, 118–50. London: Methuen, 1983.

Newman, Michael, and Elana Levine. Legitimating Television: Media Convergence and Cultural Status. New York: Routledge, 2012.

Perren, Alisa. “Rethinking Distribution for the Future of Media Industry Studies.” Cinema Journal 52, no. 3 (Spring 2013): 165–71. https://doi.org/10.1353/cj.2013.0017.https://doi.org/10.1353/cj.2013.0017

Perren, Alisa. “The Trick of the Trades: Media Industry Studies and the American Comic Book Industry.” In Production Studies, The Sequel!, edited by Miranda Banks, Bridget Conor, and Vicki Mayer, 227–37. New York: Routledge, 2015.

Porst, Jennifer. Broadcasting Hollywood: The Struggle Over Feature Films on Early TV. New Brunswick, NJ: Rutgers University Press, 2021.

Posner, Eric A., Fiona S. Morton, and E. Glen Weyl. “A Proposal to Limit the Anti-Competitive Power of Institutional Investors.” Antitrust Law Journal 81 (2017): 669–728. https://dx.doi.org/10.2139/ssrn.2872754.https://dx.doi.org/10.2139/ssrn.2872754

Schatz, Thomas. “The Studio System and Conglomerate Hollywood.” In The Contemporary Hollywood Film Industry, edited by Paul McDonald and Janet Wasko, 11–42. Malden, MA: Blackwell Publishing, 2008.

Shaver, Dan, and Mary Alice Shaver. “The Effects of Governance Structure on Reinvestment Strategies of Media Conglomerates.” In Corporate Governance of Media Companies, edited by Robert G. Picard, 47–58. Jonkoping, Sweden: Jonkoping International Business School, 2005.

Smythe, Dallas. “Communications: Blindspot of Western Marxism.” Canadian Journal of Political and Social Theory 1, no. 3 (Fall 1977): 1–27.

Wasko, Janet. Movies and Money: Financing the American Film Industry. Norwood, NJ: Ablex, 1982.

Appendix

ABC’s Fall Prime-Time Schedule (1952)

7:00 PM |

7:30 PM |

8:00 PM |

8:30 PM |

9:00 PM |

9:30PM |

10:00 PM |

10:30 PM |

|

|---|---|---|---|---|---|---|---|---|

Sunday |

You Asked For It |

Hot Scat |

All Star News |

Play House #7 |

This is the Life |

10:00 PM Hour of Decision | 10:15 PM Local |

Anywhere USA |

|

Monday |

Local |

Hollywood Screen Test |

Inspector Mark Saber |

United or Not |

All Star News |

Local |

Local |

|

Tuesday |

Local |

The Beulah Show |

Local |

|||||

Wednesday |

Local |

Name’s the Same |

All Star News |

Adventures of Ellery Queen |

Chicago Wrestling |

|||

Thursday |

Local |

Lone Ranger* |

All Star News |

Chance of a Lifetime |

Politics on Trial |

On Guard |

Local |

|

Friday |

Local |

Stu Erwin Show |

Adventures of Ozzie & Harriet |

All Star News |

Tales of Tomorrow |

Local |

||

Saturday |

Paul Whiteman’s TV Teen Club |

Live Like a Millionaire |

Feature Playhouse |

Local |

||||

*Top 30 Nielsen Program

Source: Brooks and Marsh, The Complete Directory, 11,482.

ABC’s Fall Prime-Time Schedule (1959)

7:00 PM |

7:30 PM |

8:00 PM |

8:30 PM |

9:00 PM |

9:30 PM |

10:00PM |

10:30PM |

|

|---|---|---|---|---|---|---|---|---|

Sunday |

Colt 45 |

Maverick* |

The Lawman* |

The Rebel |

The Alaskans |

Dick Clark’s World of Talent |

||

Monday |

Local |

Cheyenne* |

Bourbon Street Beat |

Adventures in Paradise |

Man with a Camera |

|||

Tuesday |

Local |

Sugarfoot/Bronco |

Life and Legend of Wyatt Earp* |

The Rifleman* |

Philip Marlowe |

Aloca Presents |

Keep Talking |

|

Wednesday |

Local |

Court of Last Resort |

Hobby Lobby Show |

Adventures of Ozzie & Harriet |

Hawaiian Eye |

Wednesday Night Fights |

||

Thursday |

Local |

Gale Storm Show |

Donna Reed Show |

Real McCoys* |

Pat Boon Chevy Showroom |

The Untouchables |

Take a Good Look |

|

Friday |

Local |

Walt Disney Presents |

Man from Blackhawk |

77 Sunset Strip** |

Robert Taylor: The Detectives |

Black Saddle |

||

Saturday |

Local |

Dick Clark Show |

High Road |

Leave It to Beaver |

Lawrence Welk Show |

Jubilee USA |

||

*Top 30 Nielsen Program

**Top 10 Nielsen Program

Source: Brooks and Marsh, The Complete Directory, 11,489.