On the eve of the 1976 Academy Awards, Robert Lindsey, the Los Angeles bureau chief for the New York Times, wrote of a “new type of power broker” enjoying a growing profile in Hollywood: the “packager” who organized tax shelters for investing in motion picture production. It was the job of this emerging category of media industry worker to, as summarized by the journalist, “evaluate proposed motion pictures, study the script and cast and then, if they think it is a good investment, put together a syndicate of high income investors.”2 The mutual benefit to investors and those involved in motion picture production explains why this practice grew in prominence during the mid-1970s: high-income investors took advantage of perceived loopholes in order to reduce their tax liability, while motion picture productions found outside sources of investment during a period in Hollywood otherwise beset by economic crisis.

Yet the precise influence of tax shelter financing on 1970s American film production has proven difficult to measure. For example, journalist Axel Madsen’s contemporaneous study of “The New Hollywood” estimated that no more than “5 percent” of motion picture funding came from outside investment, while scholar David A. Cook’s more recent history of the period locates this figure closer to 20 percent and identifies “tax shelters and other tax-leveraged investment” as “the key mode of production finance for the rest of the decade.”3 The contested extensiveness of tax shelters and similar investments in financing 1970s American films has allowed their obscure legacy to become projected onto the romanticized narrative of 1970s American feature filmmaking as a period defined by auteurist personal expression that briefly replaced the assembly-line formulae of the former studio system. Todd Berliner, for example, situates outside investment practices as a determinative component of the economic base that fostered the careers and production companies of studio auteurs and independent filmmakers whose works have formed the canon of 1970s American cinema, a practice that bankrolled films he claims “would never have received funding in other years.”4 While tax shelters and tax-leveraged investments certainly played an important role in 1970s film financing, mapping the exact scope of their implementation across the industry, or even which individual productions benefited from such practices, presents certain obstacles for the media industry historian. The viability of this practice relied on the ability of tax shelter packagers and investors to stay out of the spotlight and away from government oversight, where creative interpretations of the tax code could thrive. Moreover, tax law protects most individual investments from public disclosure, fortifying a legal barrier from knowing who invested what in which films.5 Therefore, much of what we can know about motion picture tax shelters during the 1970s exists largely through industry coverage and the attendant disclosure of those involved.

In light of such research constraints, this article seeks to illuminate how tax shelter investments operated during the 1970s through the efforts of the tax shelter packager, a media industry worker who structured new relations between the motion picture industry and finance capital.6 In so doing, this article goes beyond assertions of how tax shelters shaped the motion picture industry and shows how motion pictures became a tool for the tax shelter industry. By analyzing the work of such packagers, the following pages show how films became decentered as a means for producing profit in and of themselves, for the sheltering of investors’ tax liability was their motivating object. As Janet Wasko writes in her history of Hollywood’s long relationship to the American financial system, “individual investors, wealthy capitalists from other industries, and assorted entrepreneurs have always been active in film financing and investment,” a practice that drew the involvement of investment and commercial banks when motion pictures developed into a “viable commercial enterprise.”7 What separates tax shelter investment from Hollywood’s traditional sources of finance is that the structure of the tax shelter meant little direct oversight from investors over the content of films. This case would seem to complicate links made by scholars between the influence of finance capital and the narrowing of representational possibilities in cinema, as tax shelters offered a path for films to be produced that, as Berliner claims, may not have been supported by traditional means.8 However, adopting the perspective of tax shelter packagers—that is, that producing such films offered a direct opportunity for lowering investors’ tax burden—brings to light that any representational and/or aesthetic advancements in tax shelter-financed films were made with the tradeoff of minimizing the tax liability of people occupying top income brackets, ultimately contributing to the reduction of federal revenue, a growing culture and industry of tax resistance, and the financialization of the American motion picture industry. Using interviews with veteran tax shelter packagers, contemporaneous trade coverage, and legislative diagnoses and responses, I detail how this practice emerged; what the work of the packager entailed in their relations to the production, outside investors, and the tax code; and where to place this practice within a continued history of financialized filmmaking.

Where mentions of tax shelters have predominated existing discourse in order to give industrial context to onscreen developments in style and content in 1970s films, this article argues that tax shelter packagers’ work helped set the stage for what Andrew DeWaard terms as today’s “financialized Hollywood.” As DeWaard demonstrates, the “media giants” that dominate film and television production have become “mere investment and profit-extraction opportunities” for powerful financial firms.9 While 1970s tax shelter investment was not the first meeting between Hollywood and Wall Street, tax shelters positioned film investment within larger innovative financial strategies rather than as a “viable commercial enterprise” in and of itself. As part of the growing financialization of the US economy, tax shelter investment became an “industry” of its own in the 1970s stretching from oil to real estate and entered into motion picture production during a period of economic crisis and structural change in established studios.10 As Jeff Menne demonstrates in applying David Harvey’s political economy critique to film history, the films produced during the period we call New Hollywood were constituted by post-Fordist economic practices in which “fixed capital investments in mass-production systems” were replaced with more flexible “production models and labor markets” defined by subcontracts that connect small firms to larger corporations.11 Rather than posit New Hollywood as an aberration in the history of American commercial cinema, such analysis can illuminate how a post-studio system Hollywood attracted “risk capital and creative talent” toward the decentralized industry that formed afterward.12 As a specific category of small firm that attracted risk capital during a critical period of restructuring in film production, the 1970s motion picture tax shelter forms a key chapter in the ongoing relationship between the American motion picture industry and finance, tax law, and government regulation.13

The Growth of Tax Shelters

Before 1970, tax shelters operated in the American motion picture industry across several practices. Domestically, stars established production companies meant to shield their income.14 Abroad, industry figures reduced tax liability via overseas residency and by involving overseas companies and investors in their productions. The overseas residency practice developed from postwar “runaway productions,” wherein Hollywood studios produced films on location in Western Europe in response to a combination of incentives, including the investment of foreign earnings frozen during World War II. Several high-profile industrial actors, perhaps most famously director John Huston, took advantage of this production practice for personal tax avoidance.15 When President John F. Kennedy advocated repealing the “total tax exemption now accorded to the earned income of American citizens residing abroad,” the Screen Actors Guild supported his administration’s efforts in order to “bring back to the U.S. American motion picture production which has gone overseas because of the present income tax structure.”16 Concurrently, between 1960 and 1970, producers experimented in pursuing tax benefits by forming foreign companies and attracting foreign investors in order to accrue outside funding or bring down productions’ tax liability.17 Such scattershot efforts abroad did not develop into an industrial norm. However, the more sustained domestic tax shelters of the 1970s can be seen as an apotheosis of these incipient practices, serving as both means to reduce the tax liability of high-earning individuals and as an alternative strategy for motion picture financing. The domestic motion picture tax shelter of the 1970s emerged in a context in which Hollywood film production had, indeed, been “brought back” to the United States, but also to a domestic industry whose sources of revenue and investment were in a state of significant insecurity.

As has been widely recounted in histories of commercial American cinema during this period, motion picture studios during the 1960s endured a term of economic crisis that accumulated $600 million in combined industry losses between 1969 and 1971.18 This crisis motivated the industry to lobby Congress for tax relief in motion picture gross income but found little purchase convincing lawmakers to subsidize Hollywood amid a nationwide recession.19 While studios pursued relief through more official means, independent producers began exploring strategies to mobilize production by working around the IRS. Variety’s first mention of a new venture in motion picture tax shelter financing appeared in a May 1969 story covering a Wall Street firm’s financing of Christa (Jack O’Connell 1971), an independent Danish–American “sex-art drama” eventually released in the United States by independent and exploitation distributor American International Pictures (AIP) under the title Swedish Fly Girls. As reported by Variety, “Stewart Capital Corp., one of N.Y.’s leading services in the tax-sheltered investment field, thinks it has found a way whereby the earnings of affluent individuals can be channeled into film production as a means of avoiding the payment of income tax on such revenue.” The trade publication’s choice of the verb “thinks” is operative here, for “the fiscal and legal mechanics involved have not yet been tested by the Internal Revenue Service.”20

This early publicized example points to several directions that came to define the motion picture tax shelter. First, such practices were not, strictly speaking, the result of tax shelter packagers and firms discovering an unimpeachable tax loophole, but instead manifested via their interpretation of tax law that tested the boundaries of what the IRS and lawmakers found acceptable.21 Second, tax shelters were part of other expanding bank lending practices to motion pictures that were “not based on the proposed picture, but relied on either the guarantee of a major production-distribution company or other forms of security or collateral” that also included foreign subsidies and advance sales.22 Third, while film productions made outside of the studio system, such as Christa, were indeed among the first to test this financial strategy, several productions from struggling studios quickly looked to participate in what Variety termed “a huge new area [in] film financing.”23 This new area grew “huge” due to both its specialized financial mechanics and delimited role within the social world of filmmaking.

Tax Shelters in Practice

A 1975 congressional report on motion picture tax shelters prepared by the Joint Committee on Internal Revenue Taxation (hereafter “the IRT report”) distinguishes between two types of motion picture tax shelters that had become common: “film purchase tax shelters” in which a limited partnership “purchase[s] the rights to an already completed film,” and the “production partnership.”24 The production partnership attracted substantial industry, trade, and, eventually, governmental attention during the 1970s due to the fact that it involved outside investment in film production, requiring the work of tax shelter packagers who created production-specific limited partnerships between investors, banks, and distributors. As the report points out, “the success or failure of the film does not determine the success of the shelter,” for the principal benefit to investors was realized by the tax shelter itself.25

In explaining this benefit to his prospective clients, veteran tax shelter packager Stephen “Bill” Sharmat developed a simple pitch crafted around a single dollar: An investor would put up a cash investment of one dollar. This hard cash investment would be supported by a distribution agreement and/or completion guarantee, enabling the tax shelter packager and investors to acquire a bank loan of $3 guaranteed by the distributor, resulting in $4 for the motion picture’s production budget. The investor of $1 could write off the full $4 on their taxes (even if the motion picture was not finished with production by the filing deadline), and thus benefit in their taxes from a write-off that quadrupled their investment.26

The “investor” would often consist of a network of investors who entered into a limited partnership with the tax shelter packager. Sharmat termed these partnerships “production service companies” whose appeal to film distributors and production companies was their ability to offer “off-balance sheet financing.”27 As summarized in the IRT report, “The limited partners typically have no knowledge of the motion picture business and the production services are managed by the general partner or individual producer who is (directly or indirectly) preselected by the distributor.”28 This “general partner or individual producer” is the tax shelter packager who coordinates between the limited partnership’s investment, the bank loan, and a distributor in securing financing. The tax shelter packager would arrange financing for the film via “capital contributions by the limited partners and a substantial nonrecourse loan, which may be made by a bank, but is guaranteed by the distributor.”29 This “nonrecourse” loan reduced the risk of the investment by protecting the investor from recourse against the loan collateral they put up, thereby rendering the distributor, rather than the individual investors, responsible for paying off the loan. In the absence of ownership of the film, the partnership would often be paid a “fixed fee” for their services by the distributor in the amount of the loan that is then turned over to the bank. Taxed as income, this fee might be paid over a number of years, resulting in reduced tax liability for investors.30 This system allowed for limited partnerships to claim, typically, three or four times their actual amount of cash investment.

What happened to investors’ tax liability following the year of their investment? Given the fact that, as the IRT report points out, “all of the deductions claimed by a partner in excess of his actual investment will have to be included in his income,” one might assume that such an investment would entail a significant amount of financial risk for the investor.31 After all, the “fixed fee” meant that the partnership would later have to claim the total production cost as income. However, the initial deduction afforded investors considerable immediate benefits, including an opportunity to make further tax-deductible investments. Just as significantly, the seven-year depreciation schedule for motion pictures—that is, the schedule set by the tax code for deducting the cost of an asset meant to produce income over its useful lifetime—allowed investors time and resources to minimize any ensuing tax liability, including via further tax-sheltered investments.32 Indeed, a limited partnership could be directly mobilized toward subsequent film productions, sheltering income from an earlier production via deductions from a later production.33 This structure was modeled after a cash method of accounting that deducts expenses as they are paid, a practice typical of real estate tax shelters. However, given the fact that the short-term completion of a single motion picture production is not comparable to, say, the continual upkeep of a building that would bring about an “annual matching of deductions and income,” a production service company’s status as a trade or business existed in a legal gray area.34 Moreover, according to the IRT report, motion picture tax schedules allowed room for interpretation. Unlike real estate investments, “the useful life of a motion picture is difficult to ascertain,” which opened up avenues to appraise a film’s value based upon investor benefit.35

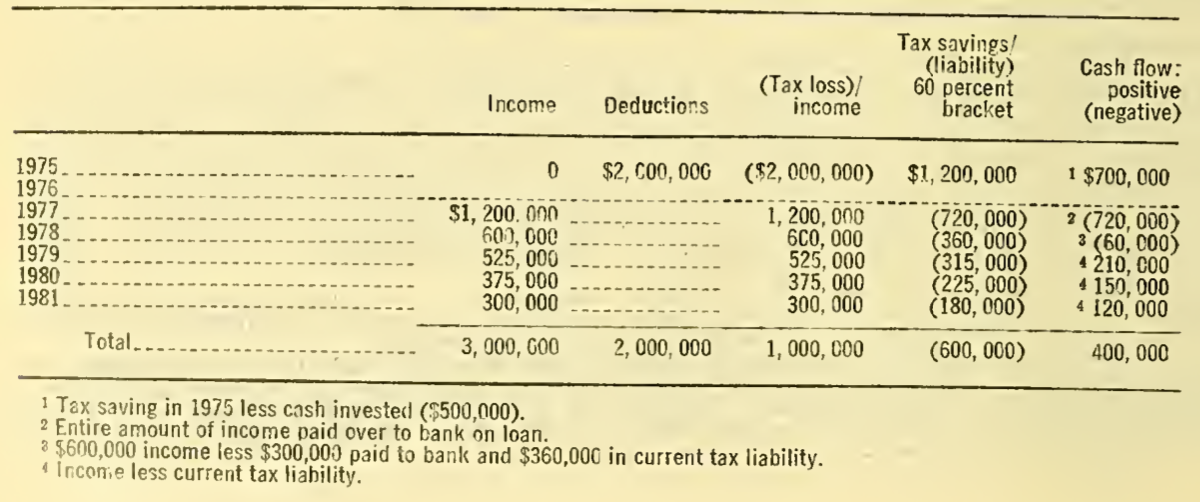

In order to illustrate how such tax shelters functioned, the IRT report outlined a straight-forward model for projecting depreciation using a hypothetical film produced in 1975. In this model, a limited partnership is formed among ten investors, all of whom are in the “60 percent tax bracket,” who contribute a total of $500,000 ($50,000 each). An agreement between the partnership and a distributor is used to secure a bank loan of $1.5 million, thus providing a $2 million production budget. The “fixed fee” of the loan amount is paid in two installments ($1.2 million and $300,000) over two years (1977 and 1978, respectively), and the investors receive a portion of the film’s $7.95 million gross profit as income between 1978 and 1981 (as represented in additional income after $1.5 million). As displayed in a depreciation chart (Figure 1), this hypothetical partnership would produce a considerable cash flow for the investors in 1975, which is then offset in 1977 and 1978 before manifesting an overall net benefit at the end of the depreciation period. Dividing these figures by the number of investors (ten) allows one to see how this practice can dramatically reshape the individual investor’s tax liability. As the report observes, “Having put up $50,000 in cash, each investor has effectively recovered all of his cash investment and also obtained the use of an extra $70,000 of tax dollars which he would otherwise have paid to the Treasury.”36 This overview not only illustrates the potential cost of this practice to the federal government but also outlines how the tax benefit itself was the object of such financing, rendering motion picture packaging into a component of a larger tax shelter industry. However, tax shelter packagers were not merely financial functionaries in this transaction—they played an important social role in facilitating, while carefully distancing, the worlds of investment and movies, and their work with investors did not always function as clearly in practice as it does in this model.

The full 1975 congressional report on motion picture tax shelters prepared by the Joint Committee on Internal Revenue Taxation.

Financial workers’ growing role in Hollywood was part of an increasing industry presence of professional intermediaries, such as talent agents and entertainment lawyers, who took on specialized functions in navigating the commercial and creative interests of parties involved in filmmaking following the dissolution of the studio system. Many such intermediaries described their formation of contracts in pre-production as “packaging.” However, where lawyers “shaped the relationship between Hollywood’s creative and financial powers” in ways that “pushed for individual creativity and gave financiers the kind of protections and incentives to promote such non-traditional practices,” as Peter Labuza argues, tax shelter packagers often arranged for a decisive distance between such powers.37 The first film that Sharmat packaged exemplifies how creative film financing emerged out of existing connections between Hollywood and Wall Street, and his subsequent work illustrates the tax shelter packager’s deliberate balance of such connections. In the early 1970s, Sharmat was working as an investment banker for Hayden, Stone & Co., a New York City-based brokerage firm. Sometime circa 1974, Daniel Glass, an entertainment lawyer, joined forces with Sharmat to find novel ways of raising funding for motion pictures for AIP through tax incentives. Glass contacted the accountant of Steve Krantz, a producer of several animated films and television series, and asked whether Krantz had a “problem” with his taxes, to which the accountant answered in the affirmative.38 Krantz’s desire to reduce his tax liability supported the financing of Cooley High (Michael Schultz 1975), a film about the everyday lives of Black high school students living in Chicago public housing. By arranging a distribution agreement with AIP in which Krantz invested 25% of the film’s budget, Glass and Sharmat could both finance the film’s production and allow the sole investor (and the film’s producer) to use Cooley High as a tax shelter. Sharmat’s success in this venture afforded him a career based in Hollywood, and he continued this practice by graduating from AIP releases to packaging high-profile studio productions such as Carrie (Brian De Palma 1976).

Rather than make success in Hollywood the object of his investors’ expenditure, Sharmat used Hollywood as a means for selling tax relief. Sharmat targeted investors in the “fifty-percent tax bracket”—as he explained to the New York Times in 1976, he pursued clients with “no less than $200,000 in net liquid assets.”39 One practice that Sharmat developed to attract such clients was to invite them to an annual weekend-long “seminar” set in his southern California home. This seminar, as he and his son, James Sharmat (now a tax attorney), recounted, consisted of a weekend-long “party” that concluded with a sit-down presentation demonstrating what these tax shelter investments could afford clients, followed by investor questionnaires. Sharmat conceded that this process did not, and was not designed to, immediately create many committed investors at the finale of the weekend, but both the seminar’s reputation and its questionnaires afforded him a stable reserve of potential clients, while curious investors could write these weekends off as a business expense given the seminar element. Two aspects of Sharmat’s work attracted potential investors: the glamour of Hollywood and the prospect of lowering their tax liability. However, because the latter element was the direct benefit to their investment, potential clients’ interest in “Hollywood” was limited to an image of the industry’s status and allure, without extending to details about the specific productions in which they might invest.40 This distance between investors and the production worked, in Sharmat’s view, to the benefit of both parties and maintained the legitimacy of the process. As Sharmat explained to the New York Times, he treated this work like “any other business investments”: “I won’t let them read a script or intrude on the set, or introduce them to the cast.”41 These investors were, in short, not creative partners in the New Hollywood. They were interested in the answer to Sharmat’s question that formed the basis of his pitch: “How would you like to not pay taxes?”42

Crediting practices were another tool used by tax shelter packagers to control the proximity between investors and Hollywood production. Production service companies shielded investors by only crediting the company itself while rarely crediting the tax shelter packager or individual investors. For example, while Krantz is credited as the producer of Cooley High, Sharmat is not, and the end credits list the film as “A Cooley High Service Company Feature” (Figure 2). Crediting is even more obscure on Carrie, where the film credits “production services” to “carrie’s group” alongside music credits, with no mention of Sharmat or investors in the production (Figure 3). Such vague crediting helped to ensure, according to Sharmat, that only the legal entity of the production service company, rather than individuals involved with it, would be subject of attention for potential audit or legal challenges.43 Moreover, the lack of a universally established name for Sharmat’s job further contributes to the goal of obscuring a film’s financial provenance. Unlike entertainment lawyers or agents, tax shelter packagers did not work for established firms, with their organizational status existing dependently upon a given production. Thus, while they were hardly the only figures in the New Hollywood doing the work of pre-production packaging, the informal title of “packager” befits their mutable position as elite freelancers who moved among insular networks of producers and investors. Tax shelter packagers’ crediting practices diverge from prevailing norms in commercial film production, for American motion picture unions’ detailed and strict thresholds for credits and layered process for handling credit disputes offer evidence of an industry that thrives on attribution.44 But for the outside investor, the economic benefits of a shelter exceeded the potential social capital of being named onscreen. This crediting process worked alongside the nonrecourse loan as methods by which investors who made up the limited partnership were shielded by the tax shelter packager from liability and unwanted attention.

The liability shield provided by the nonrecourse loan could also facilitate questionable financial practices. According to Alvin Bojar, a stockbroker-turned-tax shelter packager who used the limited partnership model to co-finance the infamous Paramount-distributed production The Klansman (Terence Young 1974), the distribution agreements that legitimized the motion picture tax shelter in the eyes of the tax code required an incredibly low threshold of requirements for investors to meet. In an unpublished memoir, Bojar recounts a pitch made by two Italian businessmen in search of an investor to purchase the U.S. distribution rights of a completed but unnamed Italian film. An example of the “film purchase tax shelter,” this proposal prompted Bojar to convince a client to provide a cash investment of $100,000 with non-recourse “notes” totaling $900,000. As explained by Bojar, the non-recourse note meant that his client had no obligation to pay this money back if the deal did not work out: “If your film grosses enough and you have the funds to meet the note, so be it. Otherwise, there’s no legal recourse.” This interpretation untethered Bojar’s investor from the film’s fate. In order for Bojar’s client to invest in the film in exchange for distribution rights, a distribution agreement with two U.S. theaters was required. Bojar recounts one of the businessmen producing a document confirming two bookings for the film: one at the Copper City Theater in Butte, Montana, “for 1:00 AM sharp on December 26th,” the other at “the Firewater Movie Palace in Gronshe, Idaho in for 5AM on January 1st.” “This was all that was required by the IRS,” Bojar writes. “It was the booking that mattered, not the where or when.”

Having witnessed Bojar recount this deal multiple times in written and oral form, it is worth emphasizing that skepticism is warranted for the exaggerated fashion in which veterans of both the motion picture and finance industries can recall their exploits.45 (For example, I could not find evidence of a “Gronshe, Idaho” in existence, and presumably the IRS required that distribution agreements be made with actual locations.) However, this anecdote of Bojar sheltering a client’s taxes through a distribution agreement for a film (that may not exist), secured through conspicuously specious bookings, bespeaks a larger byproduct of the motion picture tax shelter: creative interpretation that allowed investors to benefit from dubious financial claims. As Bojar’s enthusiastic recounting of this distribution deal indicates, regardless of how legitimate their claims were, some tax shelter packagers found pride in pursuing evermore inventive means for manufacturing tax relief for their clients. Indeed, while the stated methods of Bojar and Sharmat notably differed, their work shared the belief that they were providing an important service for wealthy clients who were being taxed at high levels during an inflationary period characterized by economic stagnation and high interest rates.46 As suggested by Bojar’s notably elaborate example of sheltering, the nature of the film itself could be irrelevant to the tax shelter packager’s pursuance of this goal.

Packaging after Domestic Tax Shelters

While ailing distributors like Columbia Pictures were aided by tax shelter financing, studios feared that this practice’s reputation for questionable deal-making, alongside rumors that tax shelters were being used to produce pornographic features, would inspire congressional action to stop the shelters altogether. Executives such as Burton Marcus, Columbia’s general counsel and vice president, proposed several reforms to minimize abuse, including “a 25 percent minimum down payment for the leveraged non-recourse loans; a five year limit on the payment of the loans; and a limitation of the tax breaks only to movies made predominately in the United States.”47 Ultimately, motion pictures were addressed directly in the Tax Reform Act of 1976 as part of the law’s implementation of “at-risk” provisions for investments that “limit[ed] the deduction of losses… to the amount the taxpayer has at-risk,” negating the possibility for a multiplied loss that had been central to the motion picture tax shelter.48 This provision resembles some of the recommendations made in the IRT report.

The Tax Reform Act of 1976 has been cited by film scholars as ending this type of motion picture tax shelter.49 Indeed, this law splintered tax shelter operations in various directions. Several former tax shelter packagers, such as lawyer Burton Kanter, transitioned to tax specialization for the corporate world, while others, such as Lawrence Gordon, developed careers as producers in Hollywood. Tax shelter packagers also extended their work to packaging motion picture tax shelters abroad in countries including West Germany, Spain, pre-revolutionary Iran, and other nations whose governments were friendly to investments similar to pre-1976 domestic tax shelters, resulting in international co-productions such as Twilight’s Last Gleaming (Robert Aldrich 1977).50 Thus, “runaway” productions returned as a strategy by which Hollywood companies and independent American filmmakers pursued film financing.

Indeed, the closure of federal tax shelter film financing in the United States coincided with a rise in tax shelter financing globally. As in the United States, tax shelter financing abroad led to the emergence or empowerment of specialized professionals and organizations serving as intermediaries between private finance, government policy, and cultural production. Canadian fiscal policy from the mid-1970s to the early 1980s sought to support a national film culture through vast tax write-offs, which attracted wealthy investors and corporations to “a new type of film entrepreneur”: tax lawyers and accountants who operated as film producers.51 As a result of industry lobbying, the Australian government signed into law the 10BA tax shelter for motion picture production in 1981 in seeking to attract private investors, who facilitated film financing through “special-purpose entities.”52 In the United Kingdom, the new Labour government of the late 1990s sought to make up for Conservative divestment in cultural subsidies for film production by facilitating new tax subsidies that led to “an abundance of specialists in film finance” who worked to reduce the tax liabilities of wealthy individuals.53 While such policies were variously developed to foster a distinct national cinema or attract U.S. film investment, they share a perspective on film financing that was consistent with a then-growing neoliberalization of public cultural investment, auguring a shift in the support of non-U.S. national cinemas from the “direct funding of feature films to the provision of indirect support to the commercial industry through taxation measures.”54

On the local level, U.S. state governments have, over several decades, implemented tax credit policies designed to attract film production. Advocates’ claims that such programs lead to local economic benefit have been contested. For example, Louisiana’s transferable tax credit for motion picture production, which reimburses producers “up to 40 percent” of their in-state production costs, has generated 36 cents in tax revenue for every dollar spent and allows a “middleman” of the production to “sell the tax credit at a discounted rate to one of the state’s companies or wealthy individuals in the oil industry.”55 In such cases, the state itself has sometimes taken on the role of a type of tax shelter packager, as states’ economic development offices compete to “craft a package of incentives” to interested film companies that “may include free road construction and other infrastructure, exclusive and expedited permitting and zoning, and of course, tax incentives.”56 While the particular position of the tax shelter packager in 1970s U.S. film financing no longer exists, the financial “packaging” of motion pictures has extended across levels global and local and sectors private and public, conducted by specialized professionals tasked to navigate the esoterica of government policy. Despite—or, more likely, because of—its limited public profile, the work of financial packaging for motion pictures has had considerable effects, taking part in tax avoidance for wealthy investors, public divestment in cultural production, and government subsidies of Hollywood productions.

Conclusion

Yet perhaps the most lasting byproduct of 1970s tax shelter packagers lies in the reorientation of the relationship between films and profit that made their work attractive to the financial sector. If the growth of financial industries created a context within which films have become “mere investment and profit—extraction opportunities” as part of a larger shift wherein the corporations that govern film production function “less as producers of goods and services and more as vehicles for speculative capital,” then tax shelter packaging, which de-centered profit from a film’s exhibition as a motive for financial investment, formed an important contribution to the financial industry’s changing perspective on the relationship between movies and money.57 Where this relationship previously depended on films to be a viable commercial enterprise, tax shelter packaging positioned film financing itself as a vehicle for investment and attendant tax avoidance. Indeed, today’s Hollywood arguably avoids profit through creative accounting and artificial losses meant to reduce reported net revenue and, therefore, tax liability via schematics built upon profit-sharing agreements with existing partnerships and investors—business relations scaffolded via the financial practices that took root during the New Hollywood.58

Tax shelter financing, like the growth of the U.S. financial sector writ large, was developed during a period in which the Keynesian status quo of government-regulated economic policy began to give way to a growing ideological insurgence that sought to minimize government spending, deregulate the financial sector, and resist taxation. The administrations of Presidents Jimmy Carter and, especially, Ronald Reagan (who used his experience in Hollywood to dramatize his perspective on taxation) enacted policies that resulted in a dramatic reduction of the tax liability of high-income earners and corporations. Yet, as high-income earners received notable tax relief, the notion that they are burdened by taxation continues to dominate conservative economic thought to the point that evermore creative practices of tax avoidance are justified as signs of business acumen—a perspective evident in the work of tax shelter packagers.

As this deregulation has extended to the twenty-first century, the structure of American taxation has spurred private equity purchases of entertainment media companies as well as converged Hollywood production with organizations that specialize in a variety of financial services, including tax credit financing.59 While such tax incentives may spur film production—or at least shape how, where, and with whom films are produced—they should be seen as part of ongoing trade-offs in American economic and tax policy between funding the public and private sectors. As Eric Hoyt argues, “On the macro level, tax policy impacts what the government can fund, employment numbers, the size of the national debt and how the tax burden is split among rich, poor and those in the middle.”60 The cost of such tradeoffs was expressed directly in 1970s tax shelter packaging, where investment in film production was used to shelter government revenue. This fact complicates the aesthetic and/or political worth attributed to 1970s films for which there is evidence of tax shelter financing. Cooley High speaks powerfully as a portrait of everyday Black life among young residents of Chicago public housing, but its production also served to lessen the tax burden of a white producer and shelter money that would otherwise be meant, in part, to support the very housing that the film depicts.

Acknowledgements

The author extends his appreciation to Tim Kennedy and Peter Labuza, as well as the journal’s editors and anonymous reviewers, for their contributions to this article.

Notes

- Landon Palmer is an Assistant Professor in the Department of Journalism and Creative Media at the University of Alabama. He is a film and media historian who researches how motion pictures have been shaped by other industries and practices throughout the second half of the twentieth century. He is the author of Rock Star/Movie Star: Power and Performance in Cinematic Rock Stardom. [^]

- Robert Lindsey, “For Best Performing Shelter …,” New York Times, March 28, 1976, 117. [^]

- Axel Madsen, The New Hollywood: American Movies in the ‘70s (New York: Crowell, 1975), 60; David A. Cook, Lost Illusions: American Cinema in the Shadow of Watergate and Vietnam, 1970–1979 (Berkeley: University of California Press, 2000), 12. See also David A. Cook, “Auteur Cinema and the ‘Film Generation’ in 1970s Hollywood,” in The New American Cinema, ed. Jon Lewis (Durham, NC: Duke University Press, 1999), 34. [^]

- Todd Berliner, Hollywood Incoherent: Narration in Seventies Cinema (Austin: The University of Texas Press, 2010), 199. In popular discourse, Peter Biskind asserts that the end of tax shelters contributed to the end of the “vitality” of 1970s American cinema in Easy Riders, Raging Bulls: How the Sex-Drugs-and Rock ‘n’ Roll Generation Saved Hollywood (New York: Simon & Schuster, 1998), 403. [^]

- 26 U.S. Code § 6103 prevents the Internal Revenue Service from disclosing tax return information. [^]

- I adopt this term from the aforementioned New York Times article. While the article describes such workers as “packagers,” my term “tax shelter packagers” distinguishes this from other practices of motion picture packaging. [^]

- Janet Wasko, Movies and Money: Financing the American Film Industry (Norwood, NJ: Ablex Publishing Corporation, 1982), xx. [^]

- Wasko’s political economy approach situates films as “ideological as well as economic components of the capitalist system [emphasis original]” and argues that the alliance of Hollywood and finance entails “the potential for corporate control and conflict as well as for creative influence and intervention.” Wasko, Movies and Money, xxi. More recently, Andrew DeWaard argues that the ongoing influence of finance capital on Hollywood “depriv[es] Hollywood of the diversity and heterogeneity it might provide the public sphere.” Andrew DeWaard, “Financialized Hollywood: Institutional Investment, Venture Capital, and Private Equity in the Film and Television Industry,” Journal of Cinema and Media Studies 59, no. 4 (Summer 2020): 56. [^]

- DeWaard, “Financialized Hollywood,” 55. [^]

- Thomas D. Simpson, “Developments in the U.S. Financial System since the Mid-1970s,” Federal Reserve Bulletin (January 1988): 1. [^]

- Jeff Menne, Post-Fordist Cinema: Hollywood Auteurs and the Corporate Counterculture (New York: Columbia University Press, 2019), 19–20. The first quote comes from David Harvey, The Condition of Postmodernity (Malden, MA: Blackwell, 1990), 142. [^]

- Quoted in Thomas Elsaesser, “American Auteur Cinema: The Last – or First – Great Picture Show,” The Last Great American Picture Show: New Hollywood Cinema in the 1970s, eds. Thomas Elsaesser, Alexander Horwath, and Noel King (Amsterdam: Amsterdam University Press, 2004), 57. [^]

- This article seeks to contribute to, and build upon, several developments in media industries studies in these areas including Jennifer Holt, Empires of Entertainment: Media Industries and the Politics of Deregulation, 1980–1996 (New Brunswick, NJ: Rutgers University Press, 2011); J. D. Connor, Hollywood Math and Aftermath: The Economic Image and the Digital Recession (New York: Bloomsbury, 2018); and the edited collection Hollywood and the Law, but particularly Eric Hoyt’s “Asset or Liability?: Hollywood and Tax Law,” Hollywood and the Law, eds. Paul McDonald, Emily Carman, Eric Hoyt, and Philip Drake (London: Bloomsbury, 2018), 183–208. [^]

- Peter Labuza, “When a Handshake Meant Something: Lawyers, Deal Making, and the Emergence of New Hollywood,” Ph.D. diss. University of Southern California, 2020, 270. [^]

- Daniel Steinhardt, Runaway Hollywood: Internationalizing Postwar Production and Location Shooting (Oakland: University of California Press, 2019), 61–63. [^]

- “Screen Actors Guild Favors Kennedy’s Plan to End Star O’Seas Tax Shelter,” Variety, June 7, 1961: 16. [^]

- “Newsletter Hints New Tax Shelter,” Variety, January 27, 1960, 5; Sid Adilman, “See Canada Ending Write Off,” Variety, December 1, 1971, 7. [^]

- Thomas Schatz, “The New Hollywood,” Film Theory Goes to the Movies, eds. Jim Collins, Hilary Radner, and Ava Preacher Collins (New York: Routledge, 1993), 15. [^]

- “Recession Hurts Too Many Others; See No ‘Save Hollywood’ Priority,” Variety, June 23, 1971, 5; A. D. Murphy, “Tax Break to Ease Pix Crisis,” Variety, September 15, 1971, 3. [^]

- “Stewart Capital Corp. ‘Designing’ New Tax Shelter, Fingers X’d; Into Film Via Art-Sexy ‘Christa,’ ” Variety, May 7, 1969, 4, 260. [^]

- As reported by the Joint Committee on Internal Revenue Taxation, “there are serious questions as to whether taxpayers are entitled to the deductions they are claiming in connection with movie shelters under present law.” Staff of the Joint Committee on Internal Revenue Taxation, “Tax Shelters: Movie Films,” US Government Printing Office, Washington, D.C. (September 10, 1975), 12; Martin S. Appel, “The Motion Picture Service Company: A Service to the Motion Picture Industry?,” Major Tax Planning 27 (1975): 568. [^]

- Wasko, Movies and Money, 157–58. [^]

- “Stewart Capital Corp,” 4. [^]

- Staff of the Joint Committee on Internal Revenue Taxation, “Tax Shelters: Movie Films,” 1. [^]

- Ibid., 7 c11. [^]

- Interview of Stephen and James Sharmat by the author, June 28, 2020; Staff of the Joint Committee on Internal Revenue Taxation, “Tax Shelters: Movie Films,” 7. [^]

- Interview of Stephen and James Sharmat by the author. [^]

- Staff of the Joint Committee on Internal Revenue Taxation, “Tax Shelters: Movie Films,” 6. [^]

- Ibid., 7. [^]

- Ibid. Whether attached to this fee, a fixed production fee is the principal means by which a tax shelter packager is remunerated for their work, often paid once the film achieves a certain point of revenue. Appel, “The Motion Picture Service Company,” 560, 566. [^]

- Staff of the Joint Committee on Internal Revenue Taxation, “Tax Shelters: Movie Films,” 7. [^]

- Interview of Stephen and James Sharmat by the author. [^]

- Staff of the Joint Committee on Internal Revenue Taxation, “Tax Shelters: Movie Films,” 7. [^]

- Appel, “The Motion Picture Service Company,” 569–571. [^]

- Staff of the Joint Committee on Internal Revenue Taxation, “Tax Shelters: Movie Films,” 2. [^]

- Ibid., 8–9. [^]

- Peter Labuza, “When a Handshake Meant Something: The Rise of Entertainment Law in Post-Paramount Hollywood,” Journal of Cinema and Media Studies 60, no. 4 (Summer 2021), 66, 81–82. [^]

- Interview of Stephen and James Sharmat by the author. [^]

- Ibid; quoted in Lindsey, “For Best Performing Shelter,” 107. [^]

- Interview of Stephen and James Sharmat by the author. [^]

- Quoted in Lindsey, “For Best Performing Shelter,” 107. [^]

- Interview of Stephen and James Sharmat by the author. [^]

- Ibid. [^]

- Catherine L. Fisk, “Will Work for Screen Credit: Labour and the Law in Hollywood,” Hollywood and the Law, eds. Paul McDonald, Emily Carman, Eric Hoyt, and Philip Drake (London: Bloomsbury, 2018), 235–62. [^]

- Alvin Bojar, “The Klansman: the true story of a motion picture fiasco,” chapter of an unpublished memoir, circa 2019, pages 6–7. Interviews with Alvin Bojar by the author. November 9, 2018 and May 18, 2019. [^]

- Bojar, “The Klansman,” 6; Interview of Stephen and James Sharmat by the author. While the mid-1970s recession was key to Sharmat’s motivations, Bojar’s manuscript emphasizes the continuity of progressive taxation in the postwar United States. [^]

- Lindsey, “For Best Performing Shelter,” 117. [^]

- W. Dennis Allred, “At-Risk Revisited: A Re-Examination of the Impact of the Tax Reform Act of 1976 on the Motion Picture Industry,” Loyola Entertainment Law Journal 2 (1982): 165; Staff of the Joint Committee on Internal Revenue Taxation, “Tax Shelters: Movie Films,” 13–14. [^]

- Cook, Lost Illusions, 12; Keith Corson, Trying to Get Over: African American Directors after Blaxploitation, 1977–1986 (Austin: University of Texas Press, 2016), 17. James Sharmat places the Tax Equity and Fiscal Responsibility Act of 1982 as the definitive end of domestic tax shelter packaging for motion pictures due to the law’s restrictions on non-recourse loans. Interview of Stephen and James Sharmat by the author; Charles Roddy, “Compliance Provisions of Tax Equity and Fiscal Responsibility Act (TEFRA),” William & Mary Annual Tax Conference 525 (1982): 134. [^]

- Frank Segers, “Germany, Spain, Iran For Tax Shelter Deals,” Variety, October 1, 1975, 5. [^]

- Wyndham Wise, “Canadian Cinema from Boom to Bust: The Tax-Shelter Years,” Take One 22 (Winter 1999): 19. [^]

- Rachel Parker and Oleg Parenta, “Multi-level Order, Friction, and Contradiction: the Evolution of Australian Film Industry Policy,” International Journal of Cultural Policy 15, no. 1 (2009): 91–105; Hoyt, “Asset or Liability?,” 196. [^]

- Maggie Magor and Philip Schlesinger, “ ‘For This Relief Much Thanks.’ Taxation, Film Policy and the UK Government,” Screen 50, no. 3 (Autumn 2009): 310. [^]

- Parker and Parenta, “Multi-level Order, Friction, and Contradiction,” 97. [^]

- Sam Karlin, “Film Tax Break Costs Louisiana Millions, New Study Shows,” The Advocate, March 28, 2019, https://www.theadvocate.com/baton_rouge/news/business/article_c1d98d48-5193-11e9-b6a0-7bc2825afed3.html; Hoyt, “Asset or Liability?,” 198. [^]

- William Luther, “Movie Production Incentives: Blockbuster Support for Lackluster Policy,” Tax Foundation 173 (January 2010): 7. [^]

- DeWaard, “Financialized Hollywood,” 55, 57. [^]

- Wasko, How Hollywood Works (London: SAGE, 2003), 99–101; Sergio Sparviero, “Hollywood Creative Accounting: The Success Rate of Major Motion Pictures,” Media Industries Journal 2, no. 1 (2015): 19–36; While some forms of creative accounting have long existed, Emily Carman and Philip Drake locate systemized practices of creative accounting in talent contracts of the 1970s. Emily Carman and Philip Drake, “Doing the Deal: Talent Contracts in Hollywood,” Hollywood and the Law, eds. Paul McDonald, Emily Carman, Eric Hoyt, and Philip Drake (London: Bloomsbury, 2018), 210. [^]

- DeWaard, “Financialized Hollywood,” 63, 69. [^]

- Hoyt, “Asset or Liability?,” 202. [^]

Bibliography

Adilman, Sid. “See Canada Ending Write Off,” Variety, December 1, 1971, 7.

Allred, W. Dennis. “At-Risk Revisited: A Re-examination of the Impact of the Tax Reform Act of 1976 on the Motion Picture Industry.” Loyola Entertainment Law Journal 2 (1982): 165–73.

Appel, Martin S. “The Motion Picture Service Company: A Service to the Motion Picture Industry?” Major Tax Planning 27 (1975): 559–600.

Berliner, Todd, Hollywood Incoherent: Narration in Seventies Cinema. Austin: The University of Texas Press, 2010.

Biskind, Peter, Easy Riders, Raging Bulls: How the Sex-Drugs-and Rock ‘n’ Roll Generation Saved Hollywood. New York: Simon & Schuster, 1998.

Bojar, Alvin. Interview with the author, November 9, 2018.

Bojar, Alvin. Interview with the author, May 18, 2019.

Bojar, Alvin. “The Klansman: The True Story of a Motion Picture Fiasco,” chapter of an unpublished memoir, circa 2019, 31 pages.

Carman, Emily and Philip Drake, “Doing the Deal: Talent Contracts in Hollywood,” Hollywood and the Law. Edited by Paul McDonald, Emily Carman, Eric Hoyt, and Philip Drake, 209–234. London: Bloomsbury, 2018.

Connor, J. D. Hollywood Math and Aftermath: The Economic Image and the Digital Recession. New York: Bloomsbury, 2018.

Cook, David A. “Auteur Cinema and the ‘Film Generation’ in 1970s Hollywood.” In The New American Cinema. Edited by Jon Lewis. Durham, NC: Duke University Press, 1999.

Cook, David A. Lost Illusions: American Cinema in the Shadow of Watergate and Vietnam, 1970–1979. Berkeley: University of California Press, 2000.

Corson, Keith, Trying to Get Over: African American Directors after Blaxploitation, 1977–1986. Austin: University of Texas Press, 2016.

DeWaard, Andrew. “Financialized Hollywood: Institutional Investment, Venture Capital, and Private Equity in the Film and Television Industry.” Journal of Cinema and Media Studies 59, no. 4 (Summer 2020): 54–84.

Elsaesser, Thomas. “American Auteur Cinema: The Last – or First – Great Picture Show.” In The Last Great American Picture Show: New Hollywood Cinema in the 1970s. Edited by Thomas Elsaesser, Alexander Horwath, and Noel King, 37–69. Amsterdam: Amsterdam Univ. Press, 2004.

Fisk, Catherine L. “Will Work for Screen Credit: Labour and the Law in Hollywood.” Hollywood and the Law. Edited by Paul McDonald, Emily Carman, Eric Hoyt, and Philip Drake, 235–62. London: Bloomsbury, 2018.

Harvey, David. The Condition of Postmodernity. Malden, MA: Blackwell, 1990.

Holt, Jennifer. Empires of Entertainment: Media Industries and the Politics of Deregulation, 1980–1996. New Brunswick, NJ: Rutgers University Press, 2011.

Hoyt, Eric. “Asset or Liability?: Hollywood and Tax Law.” Hollywood and the Law. Edited by PaulMcDonald, Emily Carman, Eric Hoyt, and Philip Drake, 183–208. London: Bloomsbury, 2018.

Karlin, Sam. “Film Tax Break Costs Louisiana Millions, New Study Shows.” The Advocate, March 28, 2019. .https://www.theadvocate.com/baton_rouge/news/business/article_c1d98d48-5193-11e9-b6a0-7bc2825afed3.html

Labuza, Peter. “When a Handshake Meant Something: Lawyers, Deal Making, and the Emergence of New Hollywood,” Ph.D. diss., University of Southern California, 2020.

Labuza, Peter. “When a Handshake Meant Something: The Rise of Entertainment Law in Post-Paramount Hollywood.” Journal of Cinema and Media Studies 60, no. 4 (Summer 2021): 61–84.

Lindsey, Robert. “For Best Performing Shelter …,” New York Times, March 28, 1976, 107, 117.

Luther, William. “Movie Production Incentives: Blockbuster Support for Lackluster Policy.” Tax Foundation 173 (January 2010): 1–16.

Madsen, Axel. The New Hollywood: American Movies in the ‘70s. New York: Crowell, 1975.

Magor, Maggie, and Philip Schlesinger. “ ‘For This Relief Much Thanks.’ Taxation, Film Policy and the UK Government.” Screen 50, no. 3 (Autumn 2009): 299–317.

Menne, Jeff. Post-Fordist Cinema: Hollywood Auteurs and the Corporate Counterculture. New York: Columbia University Press, 2019.

Murphy, A. D. “Tax Break to Ease Pix Crisis.” Variety, September 15, 1971, 3, 19.

“Newsletter Hints New Tax Shelter.” Variety, January 27, 1960, 5.

Parker, Rachel, and Oleg Parenta. “Multi-level Order, Friction, and Contradiction: The Evolution of Australian Film Industry Policy.” International Journal of Cultural Policy 15, no. 1 (2009): 91–105.

“Recession Hurts Too Many Others; See No ‘Save Hollywood’ Priority.” Variety, June 23, 1971, 5.

Roddy, Charles. “Compliance Provisions of Tax Equity and Fiscal Responsibility Act (TEFRA).” William & Mary Annual Tax Conference 525 (1982): 129–36.

Schatz, Thomas. “The New Hollywood.” In Film Theory Goes to the Movies. Edited by Jim Collins, Hilary Radner, and Ava Preacher Collins, 8–36. New York: Routledge, 1993.

“Screen Actors Guild Favors Kennedy’s Plan to End Star O’Seas Tax Shelter.” Variety, June 7, 1961, 16.

Segers, Frank. “Germany, Spain, Iran for Tax Shelter Deals.” Variety, October 1, 1975, 5, 82.

Sharmat, Stephen, and James Sharmat. Interview by the author, June 28, 2020.

Simpson, Thomas D. “Developments in the U.S. Financial System since the Mid-1970s.” Federal Reserve Bulletin (January 1988): 1–13.

Sparviero, Sergio. “Hollywood Creative Accounting: The Success Rate of Major Motion Pictures.” Media Industries Journal 2, no. 1 (2015): 19–36.

Staff of the Joint Committee on Internal Revenue Taxation. “Tax Shelters: Movie Films.” US Government Printing Office, Washington, D.C. (September 10, 1975), 15 pages.

Steinhardt, Daniel. Runaway Hollywood: Internationalizing Postwar Production and Location Shooting. Oakland: University of California Press, 2019.

“Stewart Capital Corp. ‘Designing’ New Tax Shelter, Fingers X’d; Into Film Via Art-Sexy ‘Christa.’ ” Variety, May 7, 1969, 4, 260.

Wise, Wyndham. “Canadian Cinema from Boom to Bust: The Tax-Shelter Years.” Take One 22 (Winter 1999): 17–24.

Wasko, Janet. How Hollywood Works. London: SAGE, 2003.

Wasko, Janet. Movies and Money: Financing the American Film Industry. Norwood, NJ: Ablex Publishing Corporation, 1982.