Column introduction

With the explosion of apps, tools, and sites that provide information on companies, it can be a daunting task for undergraduate business students to find and assess reliable and accurate information for class assignments and their future professional careers. Business librarians can assist both professors and students in the development and improvement of class assignments that will help aid in these challenges. In this article, David Irvin discusses some tips for assignment improvement using the newly developed librarian’s stock screener method for a finance class assignment at New Mexico State University’s College of Business. – Ryan Splenda and Eve Wider, column editors

With the recent surge of interest on social media platforms for investing in “meme stocks” like GameStop (GME), it has become apparent that financial literacy may be facing a crisis moment like other kinds of information literacy. Platforms like Reddit and Discord play host to immersive conversations between traders who are pursuing aggressive and risky options strategies. To some, this recalls the frenzied investment forums of the late 1990s (Elstein, 2021). Many anticipate similarly catastrophic results for these retail investors, as happened in the dot-com bust.

Where a new trader gets information about investment strategies could have a profound impact on their wealth. Various themes have emerged in these new forums, including the admonition that every trader must conduct their own DD, or “due diligence.” The preponderance of DD on social media indicates that a kind of financial education is taking place there, but we may assume the quality varies substantially. It would be an interesting academic exercise to archive social posts claiming to offer DD, and then compare their sentiments to actual market performance over time.

Indeed, creating accurate DD is a complex research practice typically learned in a business college classroom, rather than from social media. In American universities, business students are often asked to analyze public companies as a means to learning investment selection and strategy. Some courses simulate the trading environment with so-called “paper money,” while in advanced laboratory environments students are provided real money to invest in real markets. This teaching method gained scholarly attention in the 1990s. “The benefit for students in this arrangement is that they are able to apply the theories learned in the classroom to the management of the fund portfolio” (Grinder, et al., 1999, p. 213).

At first glance it may seem business librarians would not be involved in such learning. After all, we specialize in the selection of resources, not stocks. But the evaluation of resources is a component of information literacy, and this is where we can participate. When the object of research is a public company, the quality of information resources about that company becomes quite relevant.

In this column I will describe the concept of the “librarian’s stock screener,” which includes some tips and strategies for evaluating public companies to be included in a class research assignment. In much the same way that stock screeners can improve investment choice, the librarian can filter these public companies to improve research outcomes for class assignments, thus aiding in both financial and information literacy efforts. Since there are thousands of equities to choose from when crafting research assignments, selecting equities for effective classroom study is a complex problem that illuminates the robustness–or lack thereof--of the library’s resources.

The variables for selecting promising research companies may differ from those applied by investors for purchasing shares. However, educators should recognize that resource evaluation will provide the best learning experience for the students. This is where a librarian can help.

Background

Financial stock screeners are a convenient data-filtering tool used by investors and analysts to reduce the large number of publicly listed companies to a manageable number meeting certain financial criteria. (For example, Yahoo! Finance (https://finance.yahoo.com/screener/new/), Marketwatch.com (https://www.marketwatch.com/tools/stockresearch/screener/), and TD Ameritrade (https://research.tdameritrade.com/grid/public/screener/stocks/overview.asp) offer screeners to their clients and the public.) Stock screeners are built on the idea that traders can gain a market advantage by selecting securities using defined metrics. Metrics may include valuation criteria, dividends, indexes, exchanges, financial health ratios, and many others. As there were in 2018 some 43,342 listed domestic companies in the world (World Bank, 2021), reducing the number to a manageable subset is an important step to identifying the firms most likely to provide a return on investment.

From 2016 to 2019, as business collection liaison I engaged about 200 business students each semester through an assignment called the InfoSearch Project. Each business student was required to use a half-dozen library databases and Web resources to identify accurate information about a particular Fortune 500 company. Data points included market capitalization, financial ratios, company competitors, industry health ratios, valuation ratios, and press articles. In collaboration with the business professors, I hosted instruction sessions to help students understand the best resources to complete the assignment. The library guide established to support these students is one of the most heavily-used published guides in the library, with 15,652 views in 2019.

The professors who assigned this project maintained a list of publicly traded companies, selecting them for inclusions based on just one variable: Was the company in the Fortune 500 (https://fortune.com/fortune500/)? After about four semesters I began to see deficiencies in the list of companies. In fact, it became clear that certain companies on that list led to sub-optimal learning outcomes, generating pointless challenges, frustrated students, and even failed assignments because some students were just giving up.

I recognized that many problems could be traced back to incomplete coverage in the library’s resources. Other issues were from a general lack of analyst, media, or academic interest in particular firms. This meant the quality of research reports available to students was arbitrarily and inequitably determined by a matter of luck. (Each student had to identify an academic or press article concerning their assigned company, so lack of interest in a company became an important variable to investigate.) I discovered deficiencies in the library’s databases themselves, which placed an unfair burden on students. In instruction sessions I was promoting resources that included, at times, demonstrably false information.

In 2018, the lead professor asked me to analyze the equities from a librarian’s perspective, to ensure the InfoSearch questions could be meaningfully answered for each assigned company. Because many of the selected companies worked well with the library’s resources--yet others had profound problems--revising the list would ensure a consistent learning experience for the entire cohort, normalize the learning outcomes, and make the assessment fairer. Put simply, we believed we could identify research process problems before they occurred in the classroom.

Out of that effort I created the concept of a “librarian’s stock screener.” The systematic approach described below uses several variables by which we could “filter out” problematic companies. I hypothesized that company qualities and their financial metrics could be coded in such a way as to eliminate research problems. Succeeding here, students would not be asked to perform research that was functionally impossible to complete.

To that end, I teamed up with an MBA candidate to develop seven variables to analyze in each company on the original list of companies. I have found that using these variables to analyze companies are a great strategic way for business librarians to help professors craft more effective class assignments. The variables are:

Ticker confusion.

Change of ownership, structure, buyouts, takeovers, and delisting can happen to companies, large and small, throughout the year. It was determined that companies which had gone through a restructuring or private buyout or were delisted could spark ticker confusion: that is, the public ticker would no longer be available to use in the research, as it may have changed from one term to the next. Quick Tip: Search for the ticker symbol in a search engine like Google Finance or Yahoo! Finance. If a company’s ticker symbol has changed or been taken private, these resources will typically indicate that.

Industry category.

We determined that the companies included in the proposed list tended to fall into one or more of the following categories: retail, media, manufacturer, and wholesaler. After several semesters of experience, it seemed anecdotally true that companies that interacted directly with the public would enjoy more interest in the business journals and media. Therefore, an industry category variable was weighed when deselecting companies from our list. Quick Tip: Find a company description in a resource like Mergent, LexisNexis Uni, or on the company’s investor relations page. Look for descriptions of the company’s customers to determine whether it is primarily a consumer-facing business (retailer or media) or a company further up the supply chain (wholesaler or manufacturer).

Industry confusion.

We discovered that certain resources placed a company in one North American Industry Classification System (NAICS) class, while other resources provided different information. This seemed to be a problem with how those resources were constructed, but it was also thought that the complexity of a corporate entity could make it confusing to select an appropriate industry classification. A very large or vertically integrated company like Walt Disney Co. or Amazon.com, Inc. would each have multiple subsidiary companies that could be reasonably construed as a core business, but which exist in other NAICS classes. Quick Tip: Using the same resources as above, look for primary, secondary, and tertiary NAICS codes in the company’s dossier. Compare the codes listed in any resource that you suggest to students. If they are substantially different from one database to the next, it may make sense to eliminate that company from an assignment.

Vertical integration.

A company with substantial vertical integration caused more confusion for students in a variety of ways. Confusion could be caused by subsidiary companies that have separate, tradeable tickers. Quick Tip: Check resources like Mergent, Hoover's, or SEC.gov for the company’s subsidiary organizations. (In Mergent choose the “subsidiaries” tab to find the legal names of the owned companies). Now search for the legal name of the subsidiary organizations in an index like Google Finance to see if they are publicly traded as a separate security.

Market capitalization.

Large “market cap” companies were more likely to receive broad analyst coverage, media, and scholarly attention, and have diversified portfolios and vertical integration. Smaller market cap companies were less likely to have strong analyst interest and less likely to generate meaningful media and scholarly attention. Quick Tip: Consider a company market cap threshold (for example, any company larger than $30 billion in market cap), and then make sure that any company chosen for research meets the threshold. Most dossiers in databases and financial websites include a market cap for each company.

Business-to-business (B2B) primary.

If the primary business model of a company is to sell to other businesses rather than retail customers, it was thought that there was generally less media interest in that company. Quick Tip: Find a description of the business on the investor relations website or in a business database. Look for information about its customers. Words like wholesaler, manufacturer, or contractor may indicate that the company is primarily using a B2B model.

Library resource support.

The question emerged: Does the library have the appropriate resources to handle the questions on the project? Because students are required to use library resources to answer the questions in this project, this variable was of critical concern. Quick Tip: Review your library’s business resource holdings. Search for company-specific terms and analyze whether the results are adequate to answer the project question.

Getting it Done

It may be confusing when we use seemingly arbitrary metrics like “market cap” and “vertical integration,” but experience had shown that certain variables caused significant but arbitrary confusion to students, making those companies candidates for deselection. The purpose was not to make the lesson less complex, but to remove arbitrary points of confusion and bolster the project’s effectiveness.

The original list of 99 companies were selected based upon just one variable – market capitalization. If the company was large enough to land on the Fortune 500 company list, it could be included in the project. However, since there were 401 companies that met that standard but were not included in the project list, it was apparent that the business professors had some reason to exclude companies from the list. It was not clear what that was.

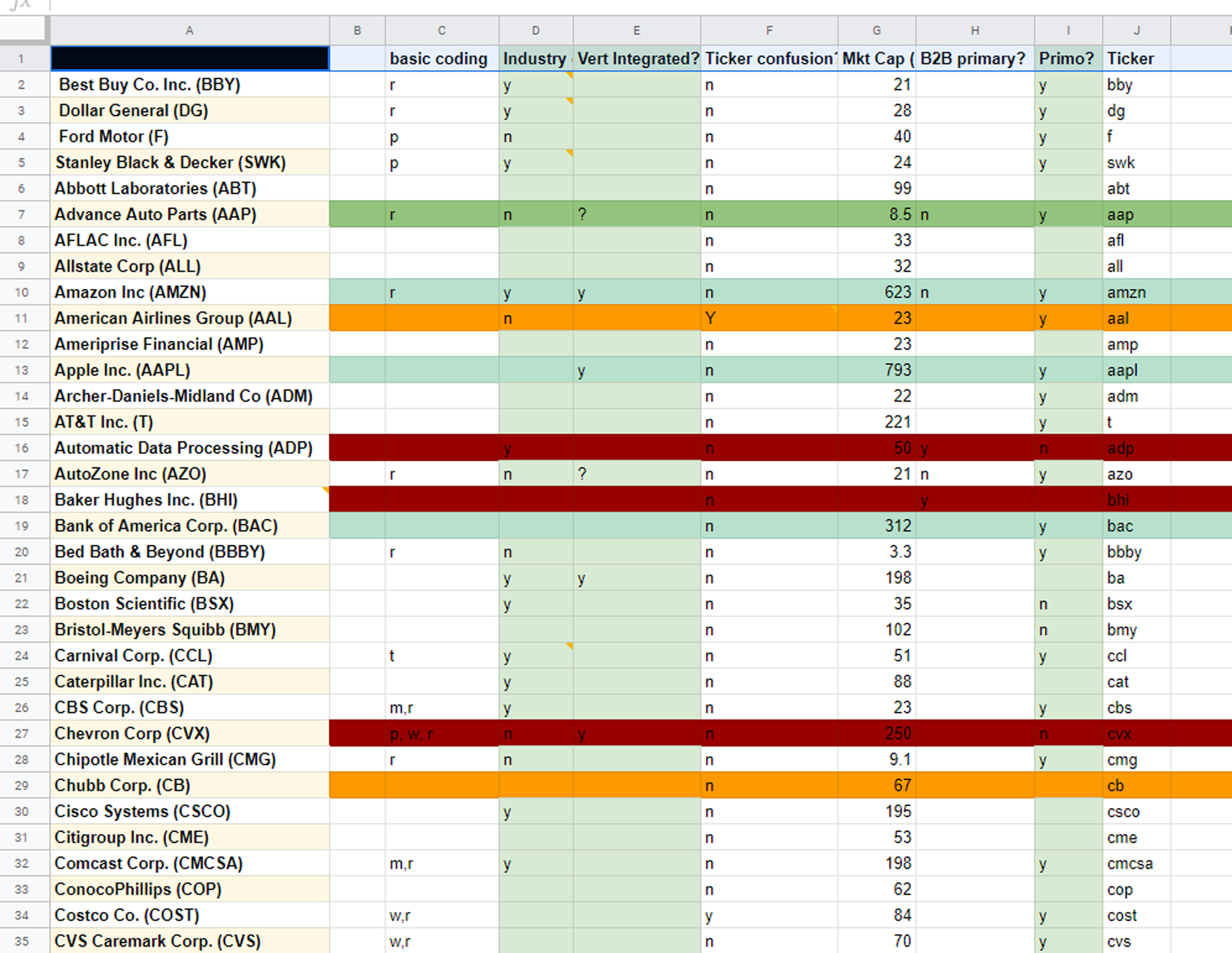

Once the companies had been added to a Google Docs spreadsheet, columns were established for each of the variables that had been identified. (See Figure 1.) Next, we researched the various data points for each company. If a company exhibited two or more possible confounding factors, it would be considered for deselection.

The research was laborious because no single resource could produce values for all variables. Resources included in the search were: Lexis Nexis-Uni, Mergent Online, Google Finance, Yahoo! Finance, and the library’s discovery tool, Primo.

Some variables required an assessment by this librarian before coding was possible. Companies are complex entities that often defy being reduced to binary categories. To take one example, the Library Resources variable (notated as Primo in Figure 1), required evaluation by the librarian before a binary choice (adequate coverage or not) could be made. Quick Tip: Use a very specific search term (like the legal name of the company or the ticker symbol) in a discovery tool like Primo, and note the number of resources that are returned. You can do this in a business-specific database, as well. After looking at several companies, set a threshold for the resource count below which a company would be excluded from use.

In some cases, the argument to remove an equity from the list was persuasive once a plurality of the variables was taken together. In simpler cases, equities clearly failed the test on multiple fronts and were immediately slated for removal.

Understanding the variety of possible results, equities researched under this framework would be separated into three categories:

Remain on the list

Possibly remove from list

Remove from list

Of the 99 equities researched during this project, 14 of those companies were deemed problematic and removed from the final list provided to students. Five companies were judged to be somewhat problematic and categorized as “possibly remove from the list.” The balance of 80 companies were to remain on the final list.

Several examples of removed companies are listed below, along with the reasoning for their removal.

Automatic Data Processing (ADP).

The company provides human resource software and services and had an annual revenue in 2018 of around $13 billion. It was struck from the list due to the variable of Industry confusion. It was determined that business-to-business was its primary customer channel, and the library lacked the text resources to support research into this company.

Staples Inc. (SPLS).

The company provides office supplies in retail outlets nationwide. It was removed from the project list because it was no longer a public company with a ticker. Once the ticker confusion was detected through the methodical approach, further research indicated that the company had been taken private for $6.9 billion in July 2017. Had we not removed it, several students would have been thrown into confusion when they attempted to research a private company for an assignment about public companies.

Lowes Cos. (LOW).

This company is a widely recognized competitor in the home supplies sector with a market capitalization of $92 billion as of January 2019. However, it was removed from the project list because it failed the industry confusion test. One database, Mergent Online, identified Lowe's primary industry as Lumber, Plywood, Millwork, and Wood Panel Merchant Wholesalers (NAICS 423310). The company dossier tool in LexisNexis Uni, on the other hand, identified the primary as Offices of Other Holding Companies (551112). While LexisNexis Uni did offer secondary NAICS codes for Lowes, none of these matched the primary code offered by Mergent. Errors or discrepancies between the databases would lead to arbitrary frustration, and companies that failed this test were automatically removed from the final list.

Snap-on Inc. (SNA).

The tool maker was excluded from the list for three reasons: It is a vertically integrated company, which confounded questions about customers and operations; both Mergent and LexisNexis Uni have named primary NAICS codes that don’t comport with each other or the facts about the company; and with a market capitalization of $10 billion (in 2017), the assumption is that it would not have generated significant scholarly inquiry.

The revised list was prepared and sent to the lead professor for the project. She responded by sending a much shorter list back to the library for inclusion in the project. Of the dozen or so companies that she proposed, 10 were included into the project going forward based on the same evaluation. In January 2019, the professor mentioned that the work to amend the project list had succeeded in reducing the number of research problems.

Finding relevance in financial literacy

Embedded librarians have opportunities to improve assignments when the professors in the colleges are open to that help. In this case, business professors sought library input to improve the list of equities available to students for a semester-long project. It was an exciting opportunity to get more involved in the classroom environment.

There is no theoretical upper limit to the size of the evaluation list nor the number of variables that would be used to evaluate them. That is to say, the size of the data set is only constrained by the speed and accuracy of the assessment system. In theory, research systems much like commercial-grade screeners could be developed in service of scholarly research on university campuses. This kind of data-driven approach to solving classroom-level problems could be considered a novel approach to embedded librarianship in multiple disciplines.

In 2020, just before the COVID-19 pandemic forced our instruction online, the business professors prevailed in changing the curriculum of this course. Afterward, some instructors dropped the InfoSearch project altogether, and others began developing new financial literacy projects. I was brought in by the lead professor to develop new instruction based on the new requirements. So even though the assignments will evolve over time, the work we did on the equities list led to new opportunities for collaboration in the business college.

Library relevance is often a place of concern for the profession. Subject-specific information literacy instruction and assignment improvement are ways we, as business librarians, may become more relevant. Opportunities will exist when business professors invite librarians into the classroom. In an era when “meme stocks” dominate the headlines and many young investors lack the investment finance literacy needed to protect their portfolios, this represents an area where business librarians may be able to help both the students and the professors who are teaching and training the world’s future investors.

References

Elstein, A. (2021, February 1). Wall Street pros turned Reddit frenzy into profits: Although demonized by amateur traders, professional investors also cashed in when targeted stocks soared. Crain’s New York Business, 37(4), 1.

Grinder, B., Cooper, D. W., & Britt, M. (1999). An integrative approach to using student investment clubs and student investment funds in the finance curriculum. Financial Services Review, 8(4) 211–221. https://doi.org/10.1016/S1057-0810(00)00040-8https://doi.org/10.1016/S1057-0810(00)00040-8

World Bank (2021). Listed domestic companies, total [Graph and table]. https://data.worldbank.org/indicator/CM.MKT.LDOM.NOhttps://data.worldbank.org/indicator/CM.MKT.LDOM.NO