Introduction

In 2019, medical school graduates had an average debt of $201,490.1 Due to this exorbitant debt, many medical students report their primary financial concern is paying off student loans2; however, they often lack the financial knowledge that could ensure their future financial security. Studies have shown that medical students, resident physicians, and fellows answer fewer than 55% of financial literacy questions correctly.3,4 Financial literacy is “the ability to use financial knowledge and skills to manage financial resources effectively for a lifetime of financial well-being.”5 Low levels of financial literacy are linked to higher debt, high-cost borrowing, and lower rates of planning for retirement and asset accumulation.6–9 This burden of educational debt, alongside low levels of financial literacy, continues to be a setback to financial well-being.

There is currently a paucity of literature investigating targeted interventions for medical student financial literacy.2,10 Resident physicians have demonstrated an interest in improving their financial literacy, resulting in many siloed interventions.11–14 Despite evidence for the need of financial literacy training, there are no standardized mechanisms for integration into medical school curricula. Given the personal and professional hazards that accompany high debt and low financial literacy upon graduation, medical schools may be well positioned in time to mitigate this burden. The purpose of this study is to evaluate perceptions regarding the importance of financial literacy among medical students and determine optimal timing and delivery for education. We hypothesized that medical students have low financial literacy, perceive financial literacy to be important, and prefer targeted financial literacy education be incorporated into their medical school curriculum.

Methods

From April to May 2019, a cross-sectional, anonymous, voluntary survey was administered to first-year (M1) to fourth-year (M4) students (n=216) at the University of Michigan Medical School. Students were invited to complete an electronically administered survey using Qualtrics (Qualtrics, Provo, UT) via email. This study was approved by the University of Michigan Institutional Review Board (HUM00158874).

A 51-item questionnaire was designed to evaluate financial literacy level, desire for financial education, preferred delivery methods and topics, financial status, debt level, and demographic factors. The financial literacy assessment portion was adapted from the Financial Industry Regulatory Authority (FINRA) Financial Literacy Quiz and included 15 items, with multiple choice and true/false questions.15 Individual financial proficiency was defined as answering greater than 60% of items correctly. Cohort financial proficiency for each item was defined as greater than 60% of respondents answering correctly. This cut-off was selected and adapted to our study by directly contacting and consulting FINRA15 experts, who indicated that a score of 60% or higher demonstrated acceptable proficiency in financial literacy. Remaining items were developed to query preferences for personal finance education based on literature review.3,4,11 Response types included multiple choice and Likert-response style questions.

Sample characteristics are described by descriptive statistics. Differences in financial literacy scores by sample characteristics were assessed using independent samples two-tailed t-tests and/or ANOVA. Initially, separate simple logistic regression models were used to test the bivariate association between the outcome of achieving financial literacy (where 1 = financially literate scoring >60% and 0 = not financially literate scoring <=60%) and the predictors of interest in taking a financial literacy course, belief that students should receive financial literacy training, and importance of increasing financial literacy. Belief that students should receive financial literacy training was significantly associated with sufficient financial literacy at the bivariate level. As such, multivariable logistic regression analysis was used to assess if the relationship between the outcome of achieving financial literacy and the belief that medical students should receive financial training as part of their education persisted, while adjusting for known confounders such as age, gender, degree sought, and medical school year. All analyses were conducted in Stata 1516 and significance was set at p<0.05.

Results

Table 1 displays demographics of our sample. The survey was completed by 216 of 680 (31.76%) students. Three-quarters of students expected to graduate with debt. Expected debt was greater than $50,000 for 135 (62.50%) students and more than $200,000 for 44 (20.37%) students. There were 54 (25.00%) students that reported no expected debt.

Demographic Characteristics of Medical Student Participants

Demographic factors |

|

|---|---|

Age (years) |

|

2-24 |

51 (24%) |

25-28 |

122 (56%) |

29-32 |

35 (16%) |

>33 |

7 (3%) |

Sex |

|

Male |

85 (39%) |

Female |

130 (60%) |

Other |

1 (0.5%) |

Race/ethnicity |

|

American Indian or Alaskan Native |

3 (1%) |

Arab |

5 (2%) |

Asian |

43 (20%) |

Black or African American |

19 (9%) |

Latino |

9 (4%) |

Native Hawaiian or Pacific Islander |

1 (0.5%) |

White |

150 (69%) |

Other |

5 (2%) |

Medical school year |

|

M1-M2 |

91 (42%) |

M3-M4 |

123 (57%) |

Degree program |

|

MD |

177 (82%) |

Joint MD/PHD |

15 (7%) |

Joint MD/MPH |

7 (3%) |

Joint MD/MBA |

4 (2%) |

Joint MD/other |

13 (6%) |

Undergraduate major |

|

Accounting/business/finance/economics |

8 (4%) |

Other |

206 (95%) |

Annual household income |

|

<$20,000 |

46 (21%) |

$20,000-$34,999 |

23 (10%) |

$35,000-$49,999 |

13 (6%) |

$50,000-$74,999 |

19 (9%) |

$75,000-$99,999 |

16 (7%) |

>$100,000 |

83 (38%) |

Parental college graduation |

|

Paternal |

161 (75%) |

Maternal |

158 (73%) |

Expected medical loan debt at graduation |

|

$0 |

54 (25%) |

$1-$49,999 |

22 (10%) |

$50,000-$99,999 |

23 (11%) |

$100,000-$149,999 |

25 (12%) |

$150,000-$199,999 |

43 (20%) |

$200,000-$249,999 |

26 (12%) |

>$250,000 |

18 (8%) |

I don’t know |

5 (2%) |

One hundred and seventy-eight students (82.41%) stated they were somewhat or very concerned about financial status, and 109 students (50.46%) did not have a plan for managing their debt. Only 8 respondents (4%) had a degree in a finance-related major. A majority of students, 142 (65.74%), stated that they were unaware of personal finance resources provided by the school or did not find them accessible.

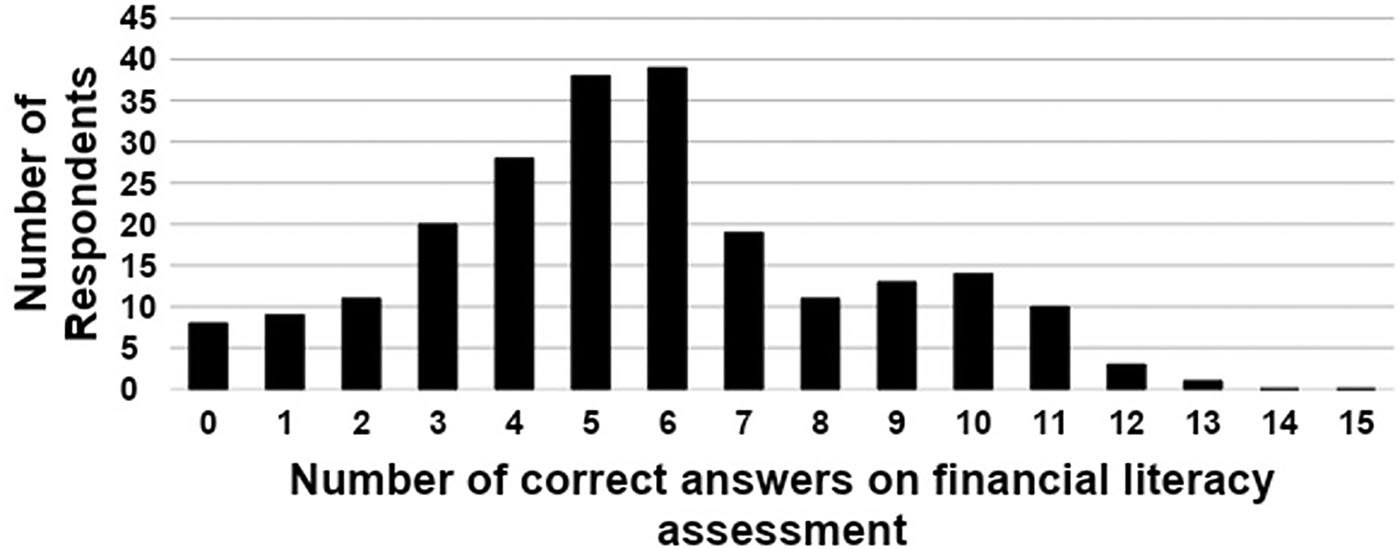

Respondents, on average, correctly answered 5.64 (37.60%) of the financial literacy questions. No respondent correctly answered all 15 items (Figure 1). Forty-one (18.98%) participants answered at least 60% of questions correctly and were considered financially proficient. On average, males scored 13% higher than females (p<0.001), ages 29 to 32 scored 12% higher than ages 21 to 24 (p=0.006), and individuals with debt scored 10% higher than those without debt (p=0.001). Individuals who were very concerned about their financial status scored 10% lower than individuals who were not concerned (p=0.03), and those who attended financial seminars throughout medical school scored 9% higher than those who did not (p=0.02). A higher percentage of students in Years 3 and 4 attained proficiency compared to students in Years 1 and 2 (25.20% vs 7.69%, p<0.001). There was no significant difference in performance on the financial literacy assessment based on degree program, household income, parental education, prior work experience, first-generation status, or race (p>0.05). The cohort overall showed proficiency in two questions related to the concepts of general investments and properties of investments. Specifically, 198 (91.67%) students correctly identified the amount of compound interest earned on savings, and 178 (82.41%) students correctly identified the statement “buying a single company’s stock usually provides a safer return than a stock mutual fund” as false. The categories of retirement savings, financial regulations, investment transactions, insurance, and taxes had no items in which the cohort was found to be proficient.

Questions were adapted from the Financial Industry Regulatory Authority (FINRA) Financial Literacy Quiz and included 15 items, with multiple choice and true/false questions.15 Individual financial proficiency was defined as answering greater than 60% (9 items) of items correctly. The cutoffs were established based on feedback from FINRA.15

Overall, 165 students (76.39%) believed increasing their financial knowledge was very or extremely important. There was a significant association between desire for financial education and perceived importance of financial literacy (odds ratio (OR)=1.12; p<0.001). Prior work experience was associated with lower desire for financial education (OR=0.027; p=0.02). Students’ debt level was not significantly associated with their desire for financial education (p>0.05). Opinion on the importance of financial literacy was not associated with age, gender, race, undergraduate major, degree program, year in medical school, parental college graduation, or prior work experience (p>0.05). Performance on the financial literacy assessment was not significantly associated with perceived importance of financial literacy or desire for training (p>0.05).

Despite the lack of association between financial literacy importance and obtaining a passing score on the assessment, the majority of students, 192 (88.89%), still believed financial education should be a part of medical training. These individuals were found to have decreased odds of obtaining a passing score on the assessment compared to their counterparts (OR=0.269; p=0.03) (Table 2). A majority of respondents, 187 students (86.57%), would take a financial literacy course offered by the medical school. Of these students interested in taking a course, 106 (56.68%) identified an online format as the preferred delivery method (Table 3). Eighty-three students (38.43%) preferred course delivery during M3/M4 years, while only 3 students (1.39%) preferred course delivery during residency (Table 3).

Unadjusted and Adjusted Logistic Regression Analysis of the Association Between Achieving Financial Literacy Proficiency and the Desire for Financial Literacy Education Among Responding Medical Students

Odds ratio |

95% CI |

P-value |

|

|---|---|---|---|

Unadjusted |

0.37 |

0.15–0.94 |

0.04 |

Adjusted |

0.27 |

0.08–0.87 |

0.03 |

Age |

|||

25–28 |

3.99 |

0.77–20.69 |

0.10 |

29–32 |

6.81 |

1.13–40.94 |

0.04 |

Gender |

0.18 |

0.08–0.42 |

0.00 |

Race |

1.24 |

0.49–3.14 |

0.64 |

Degree program |

2.65 |

0.82–8.55 |

0.10 |

Year in medical school |

3.30 |

1.16–9.43 |

0.03 |

Parental college graduation |

2.66 |

0.67–10.56 |

0.16 |

Prior employment |

0.03 |

0.002–0.34 |

<0.01 |

Medical Students’ Preference for Delivery Mechanism and Timing of Financial Literacy Education

Optimal delivery mechanism for financial literacy–related education materials* |

|

|---|---|

Online class |

106 (49%) |

Seminar series |

99 (46%) |

Didactic lectures |

70 (32%) |

Longitudinal elective |

52 (24%) |

Other |

16 (7%) |

Ideal timing for financial literacy training |

|

M3/M4 |

83 (38%) |

During college |

50 (23%) |

Prior to college |

37 (17%) |

M1/M2 |

30 (14%) |

On their own |

13 (6%) |

Residency |

3 (1%) |

*Respondents were asked to select all that apply.

Discussion

This study found that most students will graduate with significant student debt but exhibit a low level of financial literacy (Figure 1). The data indicate most students are entering medical school financially illiterate, assuming high levels of debt, and ill prepared to manage these circumstances. Most participants appreciated the importance of financial literacy and expressed a high desire to receive financial literacy training as a part of their medical education rather than waiting until residency (200 students; 92.59%). Our findings have important implications for faculty redesigning curricula and create an impetus to include non-clinical subjects such as personal finance management.

Many existing financial literacy programs are targeted at resident physicians.3,11–14 When medical students graduate and first receive a salary, many will lack the knowledge to manage their personal finances.17 Financial education in medical school provides students with the opportunity to gain financial literacy earlier and create less of a burden during a demanding residency.

In our study, students were asked to select all preferred delivery mechanisms for financial literacy–related education materials. The most frequently selected delivery format was online. Seminar series and didactic lectures were the second and third choices by frequency, respectively. Notably, an online format is compatible with self-directed learning (SDL), a process in which students take initiative in determining their learning needs, goals, and strategies and reflect on their progress.18 A motivated student would be afforded control through structural flexibility.19 While this is a learner-centered process, faculty and peers guide and reinforce SDL by offering crucial feedback. While not affording the same flexibility and control as SDL, seminar series and didactic lectures could also be viable mechanisms for programs to consider when designing curricula.

Several limitations exist in our study. This study was conducted at a single institution, which may prevent results from being generalized to the medical student population nationally. A convenience sampling method was used, which may also impact the ability to generalize these results. Additionally, the level of proficiency was set by the study authors, as there is not a standardized format for assessing proficiency, and the survey was administered online, which could vary the resources students may have had access to when answering questions. Finally, the sample size of this study was small and would benefit from dissemination to a national medical student body.

With limited financial literacy, it is possible that the additional cognitive burden medical students experience could result in poor coping behaviors, such as overspending, ignoring debt, and stress affecting physical and mental well-being. Leveraging motivation to acquire financial literacy has the potential to mitigate the negative effects of low financial literacy leading to improved overall wellness and job satisfaction.20 It is important to further explore this association between financial literacy and wellness.

Conclusion

Our results indicate that medical students have notably low financial literacy and are highly motivated to receive financial literacy education during medical school. Current strategies are neither effectively nor adequately helping learners achieve their future financial goals. Importantly, poorly managed debt burdens have been associated with increased stress, poor coping behaviors, and negative outcomes later in life. Medical schools are well situated to harness medical student motivation for financial literacy education and their desire to have control over that learning through the development and integration of SDL opportunities.

References

1 Association of American Medical Colleges. Medical student education: debt, costs, and loan repayment fact card. Published October 2019. https://apollomd.com/wp-content/uploads/2020/06/2019debtfactcard.pdfhttps://apollomd.com/wp-content/uploads/2020/06/2019debtfactcard.pdf

2 AMA Insurance. 2017 Report on U.S. Physicians’ Financial Preparedness. 2017.

3 Ahmad FA, White AJ, Hiller KM, Amini R, Jeffe DB. An assessment of residents’ and fellows’ personal finance literacy: an unmet medical education need. Int J Med Educ. 2017; 8:192–204. doi:10.5116/ijme.5918.ad1110.5116/ijme.5918.ad11

4 Jayakumar K, Larkin DJ, Ginzberg S, Patel M. Personal financial literacy among U.S. medical students. MedEdPublish. 2017; 6. doi:10.15694/mep.2017.00003510.15694/mep.2017.000035

5 Hung AA, Parker AM, Yoong JK. Defining and Measuring Financial Literacy. RAND Corporation; 2009. Working Paper WR-708.

6 Lusardi A, Mitchell OS. Baby Boomer retirement security: the roles of planning, financial literacy, and housing wealth. J Monet Econ. 2007; 54(1):205–224. doi:10.1016/j.jmoneco.2006.12.00110.1016/j.jmoneco.2006.12.001

7 Lusardi A, Mitchell OS, Curto V. Financial Literacy Among the Young: Evidence and Implications for Consumer Policy. National Bureau of Economic Research; 2009. Working Paper 15352.

8 Van Rooij MCJ, Lusardi A, Alessie RJM. Financial literacy, retirement planning and household wealth. Econ J. 2012; 122(560):449–478. doi:10.1111/j.1468-0297.2012.02501.x10.1111/j.1468-0297.2012.02501.x

9 Lusardi A, de Bassa Scheresberg C. Financial Literacy and High-Cost Borrowing in the United States. National Bureau of Economic Research; 2013. Working Paper 18969.

10 Mizell JS, Thrush CR, Steelman S. The business of medicine: a course to address the deficit in financial knowledge of fourth-year medical students. J Med Pract Manage. 2019; 34(6):344.

11 Shappell E, Ahn J, Ahmed N, Harris I, Park YS, Tekian A. Personal finance education for residents: a qualitative study of resident perspectives. AEM Educ Train. 2018; 2(3):195–203. doi:10.1002/aet2.1009010.1002/aet2.10090

12 Boehnke M, Pokharel S, Nyberg E, Clark T. Financial education for radiology residents: significant improvement in measured financial literacy after a targeted intervention. J Am Coll Radiol. 2018; 15:97–99.e1. doi:10.1016/j.jacr.2017.06.02010.1016/j.jacr.2017.06.020

13 Mills AM, Champeaux A. Financial health for the pathology trainee: fiscal prevention, diagnosis, and targeted therapy for young physicians. Arch Pathol Lab Med. 2018; 142(1):12–15. doi:10.5858/arpa.2017-0360-ED10.5858/arpa.2017-0360-ED

14 Mizell JS, Berry KS, Kimbrough MK, Bentley FR, Clardy JA, Turnage RH. Money matters: a resident curriculum for financial management. J Surg Res. 2014; 192(2):348–355. doi:10.1016/j.jss.2014.06.00410.1016/j.jss.2014.06.004

15 Lin JT, Bumcrot C, Ulicny T, et al. The State of U.S. Financial Capability: The 2018 National Financial Capability Study. Finra Investor Education Foundation; 2018.

16 Stata [Statistical software]. Release 15. College Station, TX: StataCorp LLC; 2017.

17 Teichman, JMH, Cecconi PP, Bernheim BD, et al. How do residents manage personal finances? Am J Surg. 2005; 189(2):134–139. doi:10.1016/j.amjsurg.2004.11.00710.1016/j.amjsurg.2004.11.007

18 Knowles MS. Self-Directed Learning: A Guide for Learners and Teachers. Association Press; 1975.

19 Bandura A. Self-Efficacy: The Exercise of Control. Freeman; 1997.

20 McNeeley MF, Perez FA, Chew FS. The emotional wellness of radiology trainees: prevalence and predictors of burnout. Acad Radiol. 2013; 20(5):647–655. doi:10.1016/j.acra.2012.12.01810.1016/j.acra.2012.12.018